Question: 3. (a) Explain why a measure offund manager performance such as the Sharpe ratio controls for the amount of risk in the fund's investments. Why

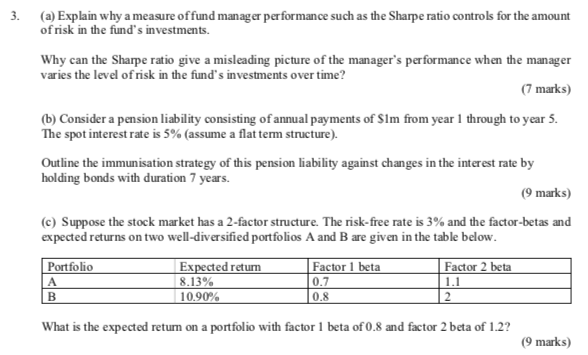

3. (a) Explain why a measure offund manager performance such as the Sharpe ratio controls for the amount of risk in the fund's investments. Why can the Sharpe ratio give a misleading picture of the manager's performance when the manager varies the level of risk in the fund's investments over time? (7 marks) (6) Consider a pension liability consisting of annual payments of $lm from year 1 through to year 5. The spot interest rate is 5% (assume a flat term structure). Outline the immunisation strategy of this pension liability against changes in the interest rate by holding bonds with duration 7 years. (9 marks) (C) Suppose the stock market has a 2-factor structure. The risk-free rate is 3% and the factor-betas and expected returns on two well-diversified portfolios A and B are given in the table below. Portfolio Expected return Factor 1 beta Factor 2 beta 8.13% 0.7 1.1 10.90% B 0.8 2 What is the expected return on a portfolio with factor 1 beta of 0.8 and factor 2 beta of 1.2? (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts