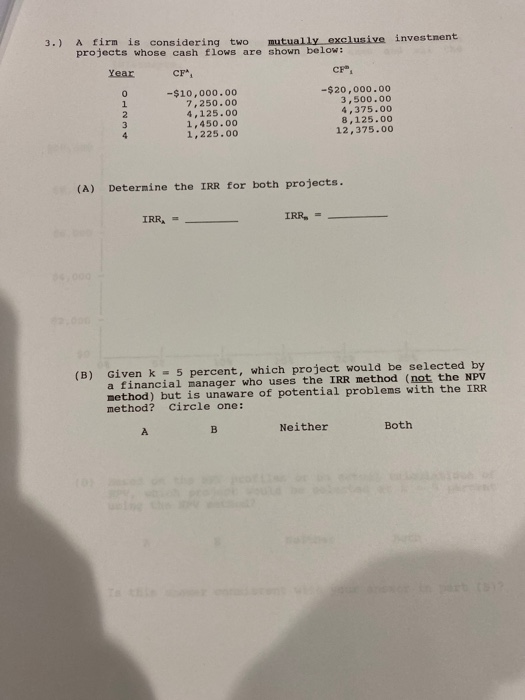

Question: 3.) A firm is considering two projects whose cash flows are shown below: mutually exclusive investnent CF* CF Year -$20,000.00 3,500.00 4,375.00 8,125.00 12,375.00 -$10,000.00

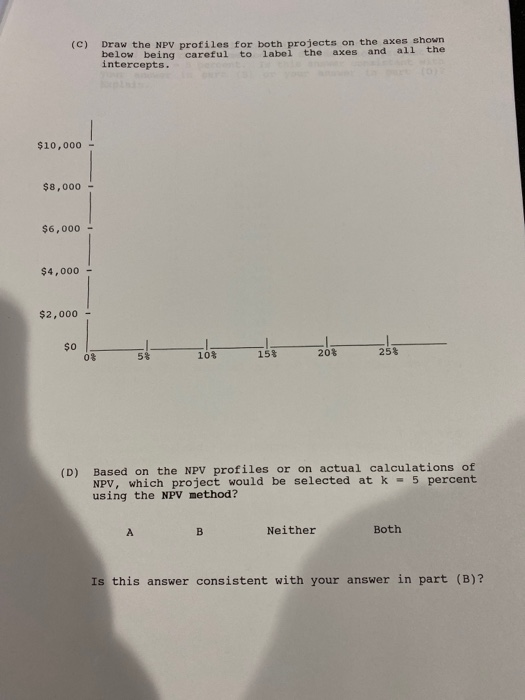

3.) A firm is considering two projects whose cash flows are shown below: mutually exclusive investnent CF* CF Year -$20,000.00 3,500.00 4,375.00 8,125.00 12,375.00 -$10,000.00 7,250.00 4,125.00 1,450.00 1,225.00 1 2 4 Deternine the IRR for both projects. (A) IRR, IRR Given k 5 percent, which project would be selected by a financial manager who uses the IRR method (not the NPV method) but is unaware of potential problems with the IRR method? circle one: (B) Neither Both A (C) Draw the NPV profiles for both projects on the axes shown axes and all the below being careful to label intercepts. the $10,000 $8,000 $6,000 $4,000 $2,000 $0 0% 258 20% 15% 10% 5% Based on the NPV profiles or on actual calculations of NPV, which project would be selected at k 5 percent using the NPV method? (D) Neither Both A B Is this answer consistent with your answer in part (B)? (E) Now apply incremental analysis and again use the IRR method (not the NPV method) to decide which project to select at k-5 percent. your answer in part (B) or your answer in part (D)? Explain. Is this answer consistent with 34/300 34,380 34, 380 34,380 34/380 34:3s0 34,380 25 26 caloulate th te Rate o atorn( o ta project. uppode the it co Caloulato the Hodirid project peren )ot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts