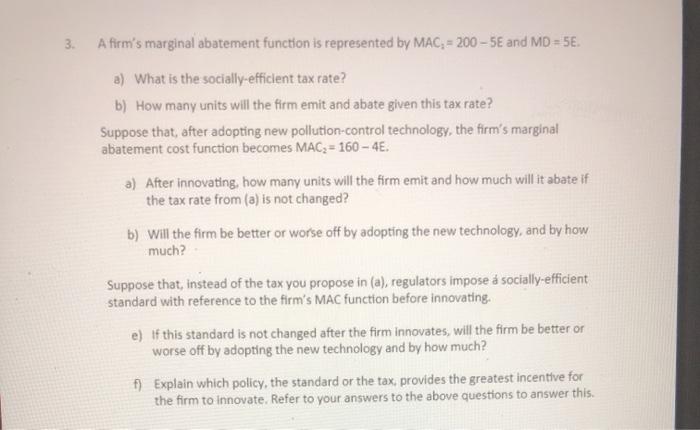

Question: 3. A firm's marginal abatement function is represented by MAC, = 200-5E and MD = 5E. a) What is the socially-efficient tax rate? b)

3. A firm's marginal abatement function is represented by MAC, = 200-5E and MD = 5E. a) What is the socially-efficient tax rate? b) How many units will the firm emit and abate given this tax rate? Suppose that, after adopting new pollution-control technology, the firm's marginal abatement cost function becomes MAC=160-4E. a) After innovating, how many units will the firm emit and how much will it abate if the tax rate from (a) is not changed? b) Will the firm be better or worse off by adopting the new technology, and by how much? Suppose that, instead of the tax you propose in (a), regulators impose socially-efficient standard with reference to the firm's MAC function before innovating. e) If this standard is not changed after the firm innovates, will the firm be better or worse off by adopting the new technology and by how much? f) Explain which policy, the standard or the tax, provides the greatest incentive for the firm to innovate. Refer to your answers to the above questions to answer this.

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Question The first step is to calculate the enthalpy of the inlet air and ... View full answer

Get step-by-step solutions from verified subject matter experts