Question: 3. A protective put (a long stock + a long put) An investor purchases a BAC stock at $34.0 and she immediately longs a 35

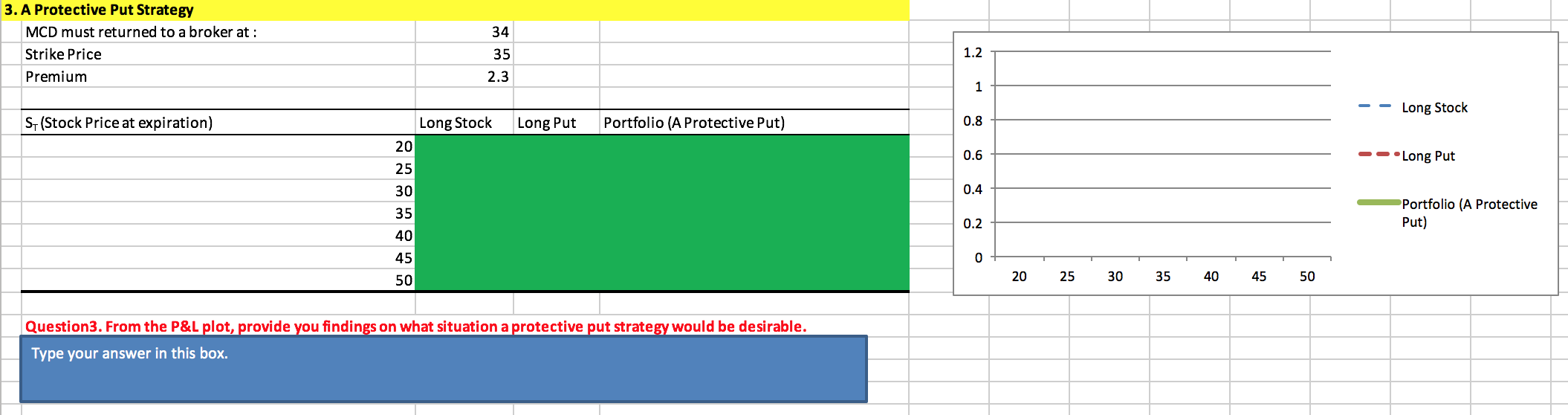

3. A protective put (a long stock + a long put) An investor purchases a BAC stock at $34.0 and she immediately longs a 35 put BAC option. Its option premium is $2.3. 3. A Protective Put Strategy MCD must returned to a broker at : Strike Price Premium 34 35 2.3 1.2 1 -- Long Stock S(Stock Price at expiration) Long Stock Long Put Portfolio (A Protective Put) 0.8 20 0.6 --Long Put 25 0.4 Portfolio (A Protective Put) A5 20 25 30 35 40 45 50 Question3. From the P&L plot, provide you findings on what situation a protective put strategy would be desirable. Type your answer in this box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts