Question: 3. A stock S has value S = 4 today and in one year the value either doubles to 8 or halves to 2. Assuming

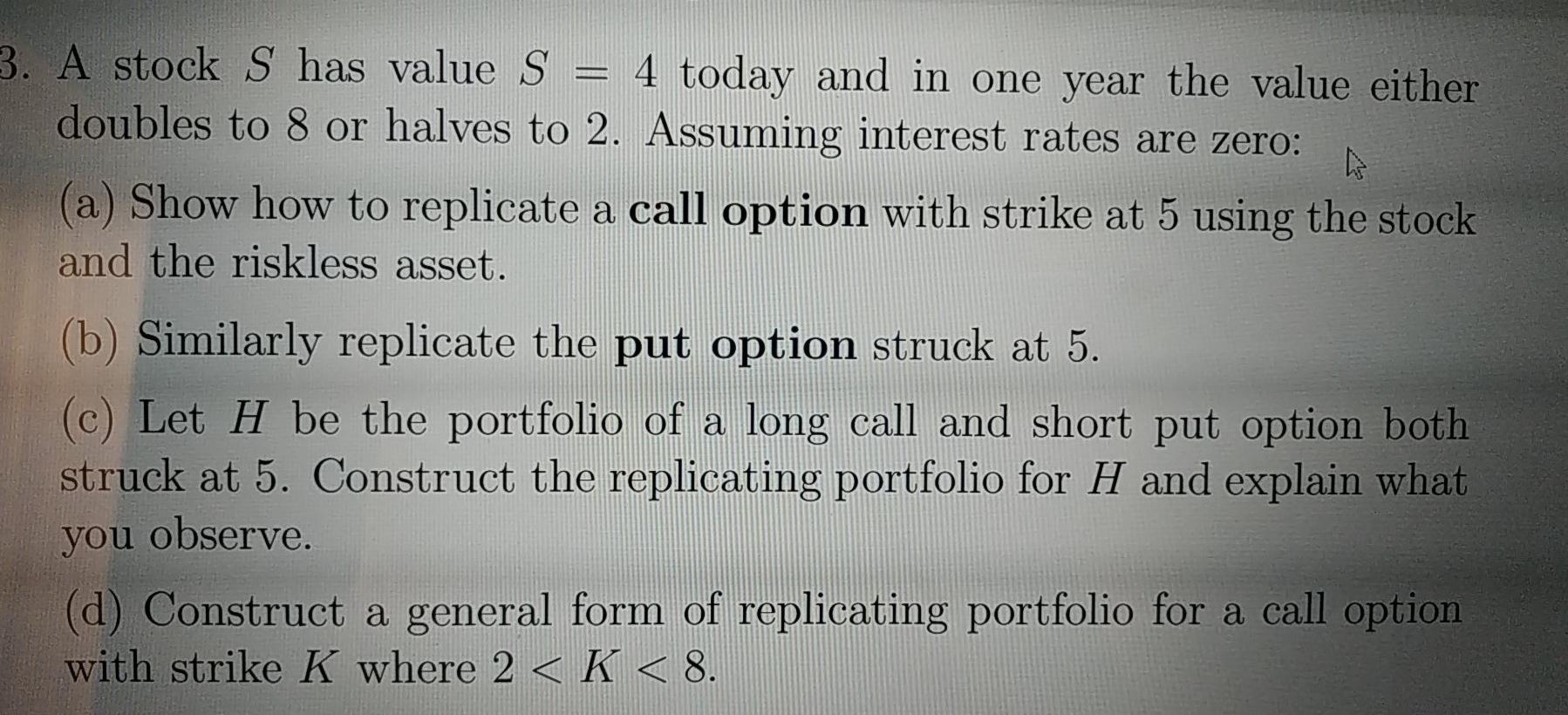

3. A stock S has value S = 4 today and in one year the value either doubles to 8 or halves to 2. Assuming interest rates are zero: (a) Show how to replicate a call option with strike at 5 using the stock and the riskless asset. (b) Similarly replicate the put option struck at 5. (c) Let H be the portfolio of a long call and short put option both struck at 5. Construct the replicating portfolio for H and explain what you observe. (d) Construct a general form of replicating portfolio for a call option with strike K where 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts