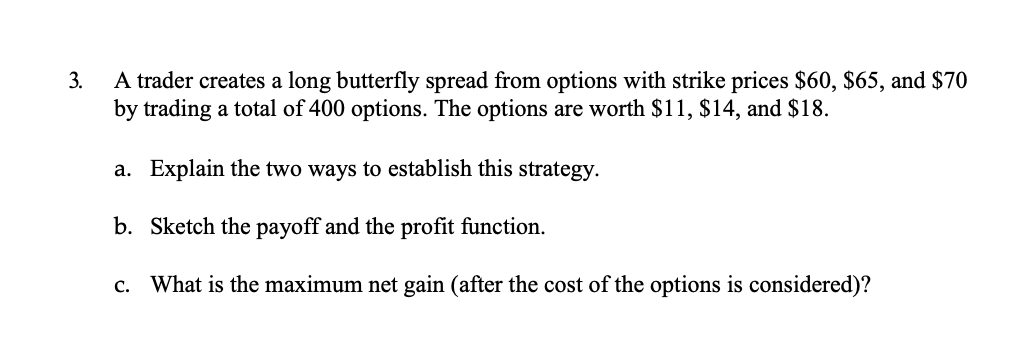

Question: 3. A trader creates a long butterfly spread from options with strike prices $60, $65, and $70 by trading a total of 400 options. The

3. A trader creates a long butterfly spread from options with strike prices $60, $65, and $70 by trading a total of 400 options. The options are worth $11, $14, and $18. a. Explain the two ways to establish this strategy. b. Sketch the payoff and the profit function. c. What is the maximum net gain (after the cost of the options is considered)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts