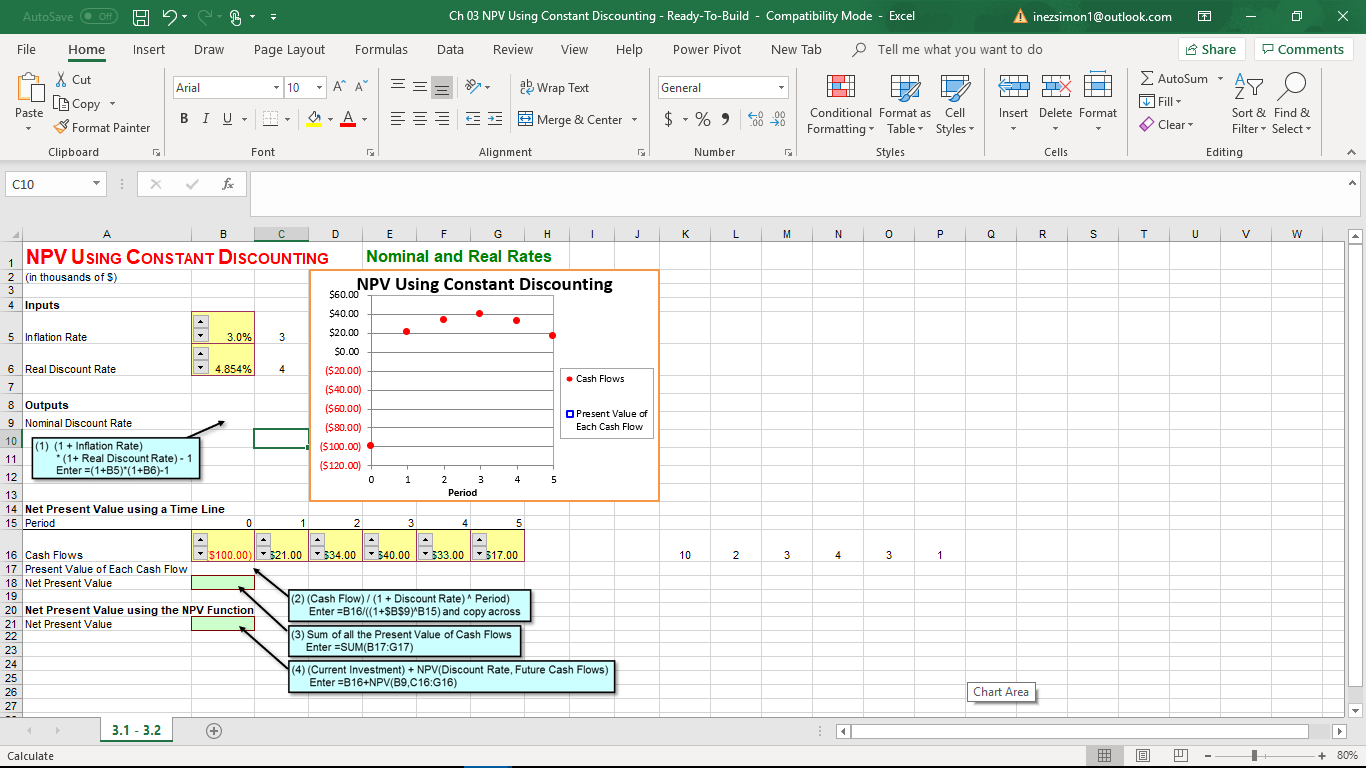

Question: 3. a)Can the constant discount rate method shown in Figure 3.1 be used to calculate NPV in the general case where the discount rate changes

3. a)Can the constant discount rate method shown in Figure 3.1 be used to calculate NPV in the general case where the discount rate changes over time? Why or Why not?

3. a)Can the constant discount rate method shown in Figure 3.1 be used to calculate NPV in the general case where the discount rate changes over time? Why or Why not?

b)Is the Net Present Value of the project shown in Figure 3.1 acceptable for investment why or why not?

c)If we add the inflation rate and the real discount rate to get the nominal discount rate, fully state what we will miss compared to the formula in cell B9 of Figure 3.2.

A inezsimon1@outlook.com Ch 03 NPV Using Constant Discounting - Ready-To-Build - Compatibility Mode - Excel X AutoSave Off GH Formulas View Help File Review Power Pivot New Tab Tell me what you want to do Share Home Insert Draw Page Layout Data Comments AutoSum ' XCut 10A A ab Ce ET TTX Wrap Text Arial General Paste Copy Format Painter Fill Conditional Format as Cell Insert Delete Format Sort & Find & A E E Merge & Center 0 0C BIU 000 Clear Formatting Table Styles Filter Select Clipboard Font Alignment Number Styles Cells Editing fox C10 B D E F H K L M N O P R S T U v W NPV USING CONSTANT DISCOUNTING Nominal and Real Rates 1 (in thousands of S) NPV Using Constant Discounting 3 $60.00 4 Inputs $40.00 $20.00 5 Inflation Rate 3.0% 3 0.00 6 Real Discount Rate 4.854% 4 ($20.00) Cash Flows 7 ($40.00) 8 Outputs ($60.00) OPresent Value of 9 Nominal Discount Rate ($80.00) Each Cash Flow 10 (1) (1Inflation Rate) (1+Real Discount Rate) 1 Enter (1+B5) (1+B6)-1 ($100.00) 11 ($120.00) 12 1 2 4 Period 13 14 Net Present Value using a Time Line 15 Period 0 1 2 3 4 $100.00)521.00 34.00 40.00 33.00 17.00 16 Cash Flows 10 2 3 4 3 1 17 Present Value of Each Cash Flow 18 Net Present Value (2) (Cash Flow) / (1 Discount Rate)A Period) Enter B16/((1+$B$9)MB15) and copy across 19 20 Net Present Value using the NPV Function 21 Net Present Value (3) Sum of all the Present Value of Cash Flows Enter SUM(B17:G17) 22 23 24 (4) (Current Investment) NPV(Discount Rate, Future Cash Flows) Enter -B16+NPV(B9,C16:G16) 25 Chart Area 26 27 3.1 3.2 Calculate 80% st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts