Question: 3. Accounting for Derivative Securities Fair Value Hedge (20 points) On 1 October 20X4 Smiths Company, a mining entity had 100,000 pounds of copper that

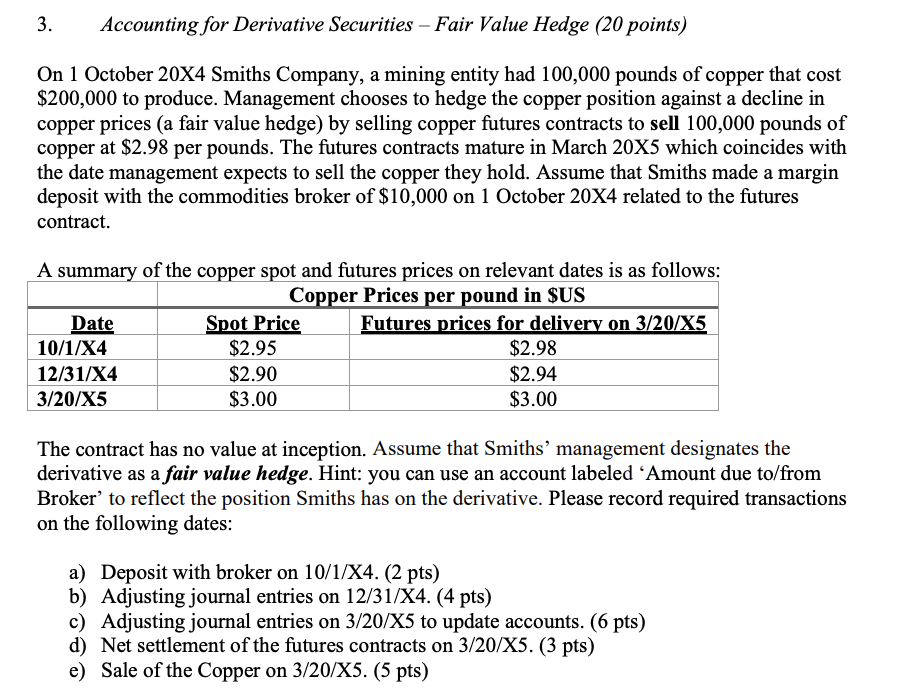

3. Accounting for Derivative Securities Fair Value Hedge (20 points) On 1 October 20X4 Smiths Company, a mining entity had 100,000 pounds of copper that cost $200,000 to produce. Management chooses to hedge the copper position against a decline in copper prices (a fair value hedge) by selling copper futures contracts to sell 100,000 pounds of copper at $2.98 per pounds. The futures contracts mature in March 20X5 which coincides with the date management expects to sell the copper they hold. Assume that Smiths made a margin deposit with the commodities broker of $10,000 on 1 October 20X4 related to the futures contract. A summary of the copper spot and futures prices on relevant dates is as follows: Copper Prices per pound in $US Date Spot Price Futures prices for delivery on 3/20/X5 10/1/X4 $2.95 $2.98 12/31/X4 $2.90 $2.94 3/20/X5 $3.00 $3.00 The contract has no value at inception. Assume that Smiths' management designates the derivative as a fair value hedge. Hint: you can use an account labeled 'Amount due to/from Broker' to reflect the position Smiths has on the derivative. Please record required transactions on the following dates: a) Deposit with broker on 10/1/X4. (2 pts) b) Adjusting journal entries on 12/31/X4. (4 pts) c) Adjusting journal entries on 3/20/X5 to update accounts. (6 pts) d) Net settlement of the futures contracts on 3/20/X5. (3 pts) e) Sale of the Copper on 3/20/X5. (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts