Question: 3. Adele, a 45-year old grandparent, has assumed the care of her 10-year old granddaughter Mindy after the death of her daughter and son-in-law in

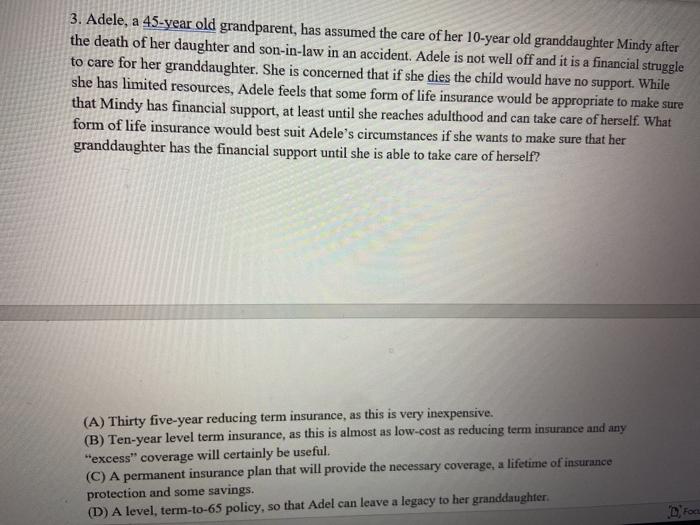

3. Adele, a 45-year old grandparent, has assumed the care of her 10-year old granddaughter Mindy after the death of her daughter and son-in-law in an accident. Adele is not well off and it is a financial struggle to care for her granddaughter. She is concerned that if she dies the child would have no support. While she has limited resources, Adele feels that some form of life insurance would be appropriate to make sure that Mindy has financial support, at least until she reaches adulthood and can take care of herself. What form of life insurance would best suit Adele's circumstances if she wants to make sure that her granddaughter has the financial support until she is able to take care of herself? (A) Thirty five-year reducing term insurance, as this is very inexpensive. (B) Ten-year level term insurance, as this is almost as low-cost as reducing term insurance and any excess" coverage will certainly be useful. (C) A permanent insurance plan that will provide the necessary coverage, a lifetime of insurance protection and some savings. (D) A level, term-to-65 policy, so that Adel can leave a legacy to her granddaughter, Foc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts