Question: 3 Aguirrev.FSA Home Insert Draw Page Layout Formulas Data Review View Tell me 10 Paste Conditio Farmatt Times New Roman ' = 25 Wrap Text

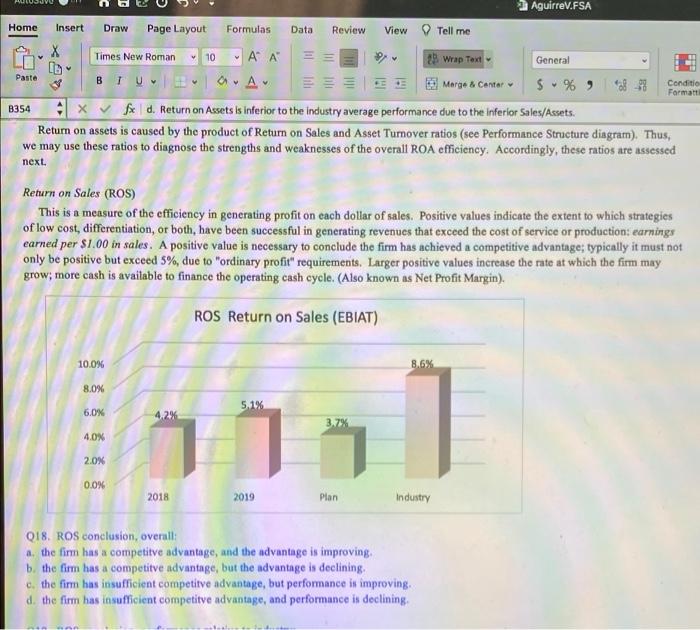

3 Aguirrev.FSA Home Insert Draw Page Layout Formulas Data Review View Tell me 10 Paste Conditio Farmatt Times New Roman ' = 25 Wrap Text General BTU a. Au Marge & Center $%98-98 A XV fx d. Return on Assets is inferior to the industry average performance due to the Inferior Sales/Assets. Return on assets is caused by the product of Return on Sales and Asset Turnover ratios (see Performance Structure diagram). Thus, we may use these ratios to diagnose the strengths and weaknesses of the overall ROA efficiency. Accordingly, these ratios are assessed B354 next. Return on Sales (ROS) This is a measure of the efficiency in generating profit on each dollar of sales. Positive values indicate the extent to which strategies of low cost, differentiation, or both, have been successful in generating revenues that exceed the cost of service or production: earnings earned per $1.00 in sales. A positive value is necessary to conclude the firm has achieved a competitive advantage; typically it must not only be positive but exceed 5%, due to "ordinary profit" requirements. Larger positive values increase the rate at which the firm may grow; more cash is available to finance the operating cash cycle. (Also known as Net Profit Margin). ROS Return on Sales (EBIAT) 10.0% 8.6% 8.0% 5.1% 6.0% 4,2% 3.7% 4.ON 2.0% 0.0% 2018 2019 Plan Industry Q18. ROS conclusion, overall: a, the firm has a competitve advantage, and the advantage is improving. b. the firm has a competitve advantage, but the advantage is declining. c. the firm has insufficient competitve advantage, but performance in improving. d. the firm has insufficient competitve advantage, and performance is declining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts