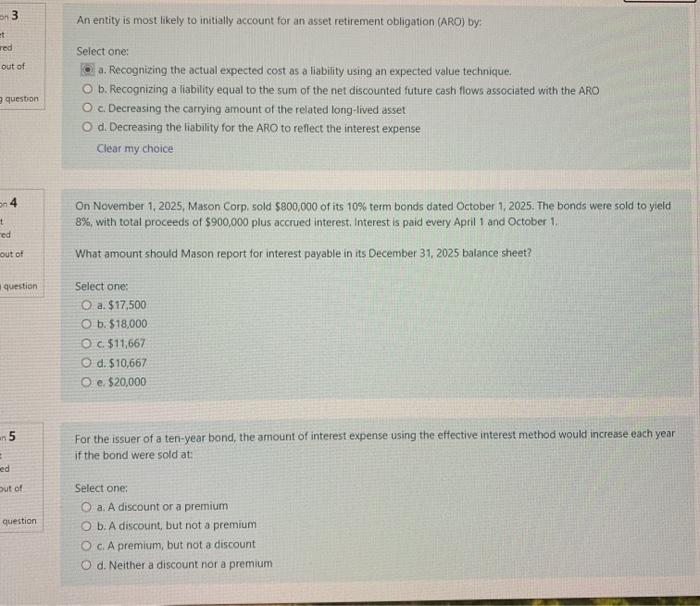

Question: 3 An entity is most likely to initially account for an asset retirement obligation (ARO) by: et red out of question Select one: a. Recognizing

3 An entity is most likely to initially account for an asset retirement obligation (ARO) by: et red out of question Select one: a. Recognizing the actual expected cost as a liability using an expected value technique. b. Recognizing a liability equal to the sum of the net discounted future cash flows associated with the ARO O c. Decreasing the carrying amount of the related long-lived asset O d. Decreasing the liability for the ARO to reflect the interest expense Clear my choice 04 On November 1, 2025, Mason Corp. sold $800,000 of its 10% term bonds dated October 1, 2025. The bonds were sold to yield 8%, with total proceeds of $900,000 plus accrued interest. Interest is paid every April 1 and October 1 + ed out of What amount should Mason report for interest payable in its December 31, 2025 balance sheet? question Select one: O a. $17.500 O b. $18,000 O c. $11,667 O d. $10,667 O e $20,000 en 5 5 For the issuer of a ten-year bond, the amount of interest expense using the effective interest method would increase each year if the bond were sold at: ed out of question Select one: O a. A discount or a premium O b. A discount, but not a premium O c A premium, but not a discount O d. Neither a discount nor a premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts