Question: #3 and Decision Case. Thank you for your help Heartstrings Music Company Trial Balance February 29, 2018 Trial Balance Account Debit Credit Cash $6,000 Accounts

#3 and Decision Case. Thank you for your help

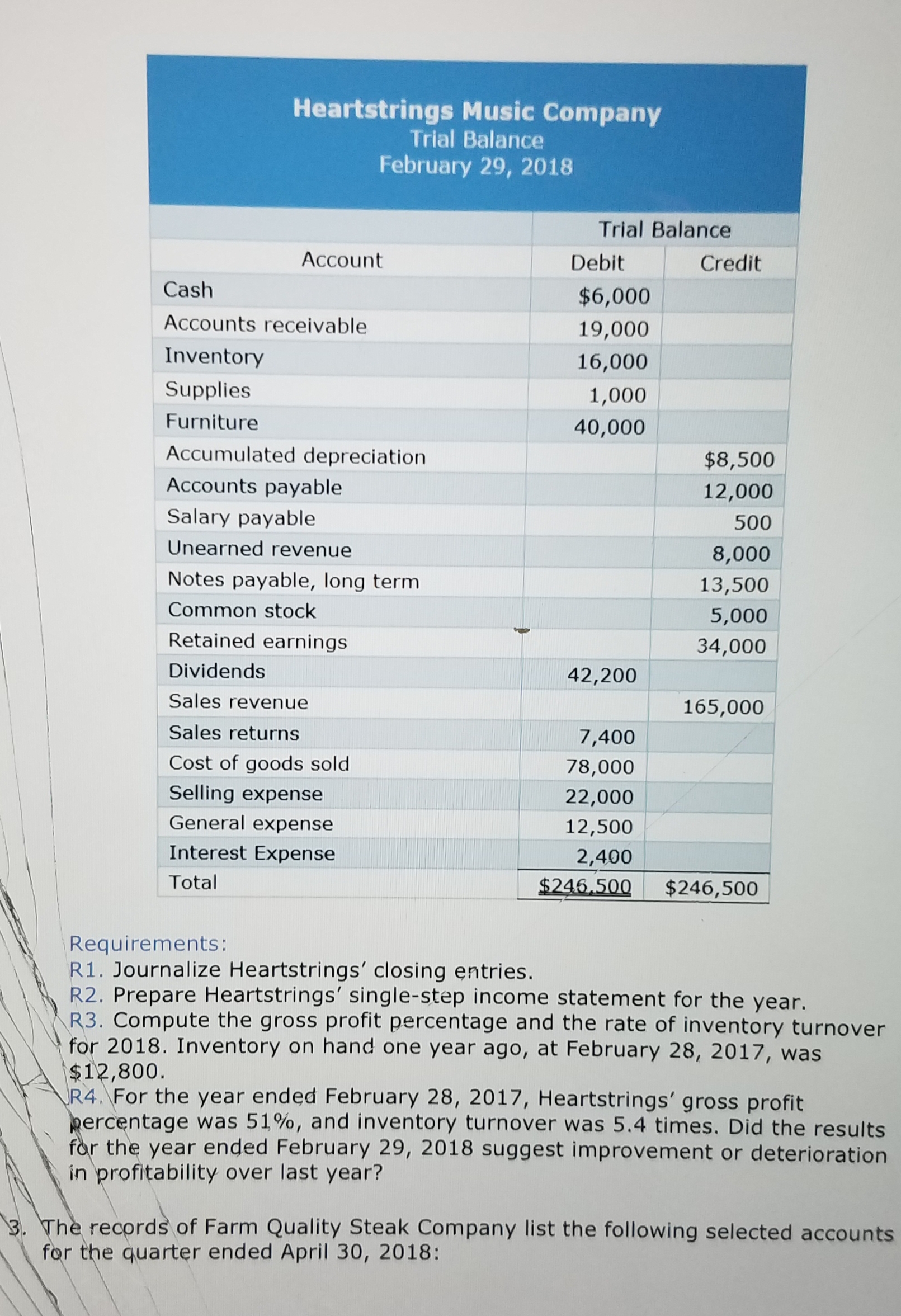

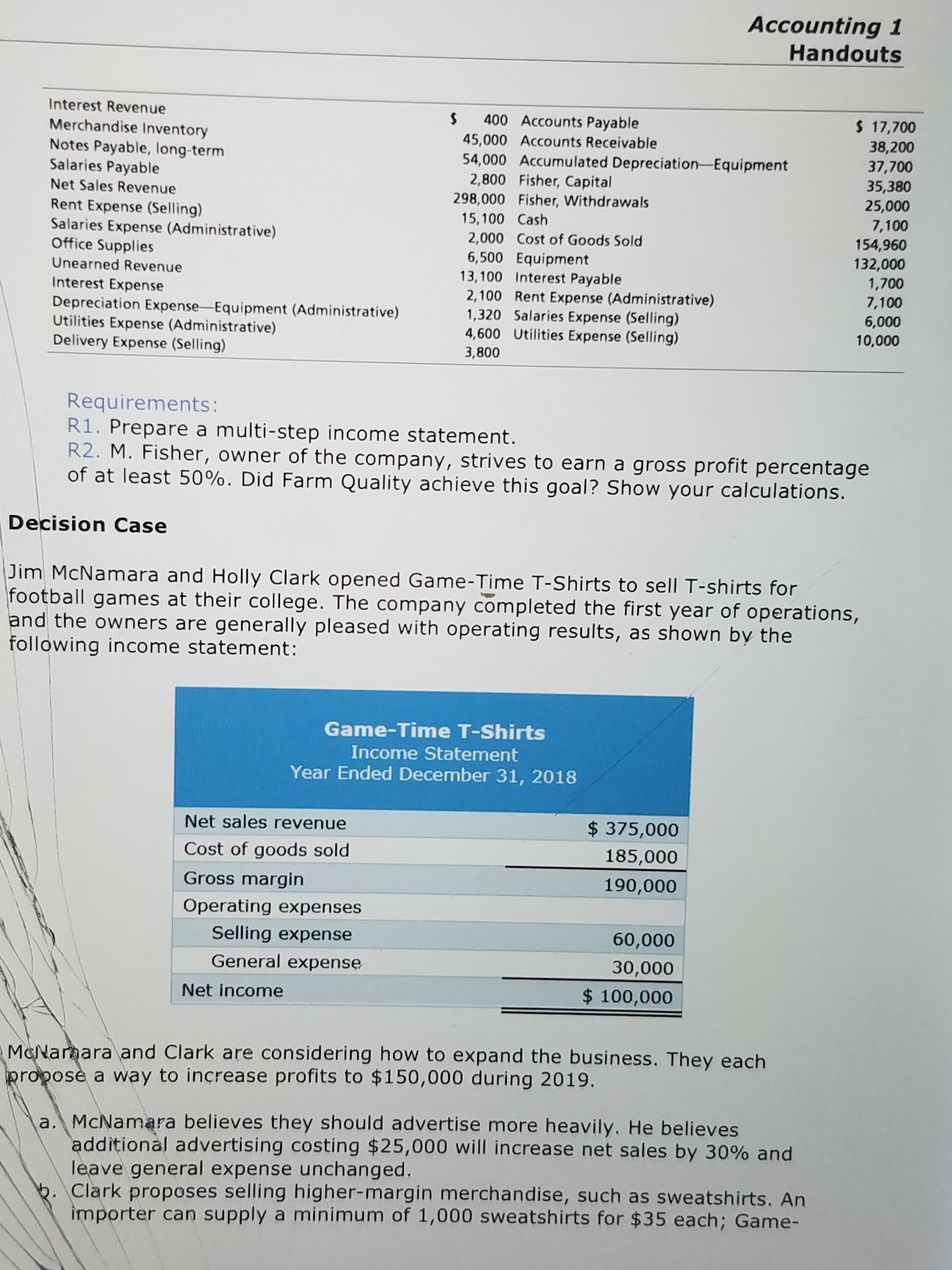

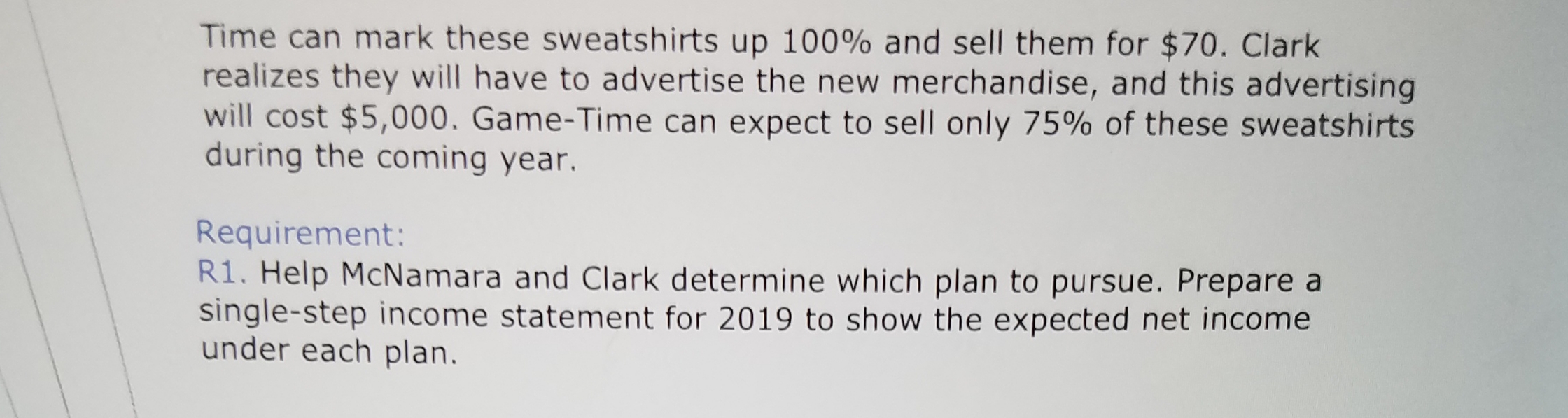

Heartstrings Music Company Trial Balance February 29, 2018 Trial Balance Account Debit Credit Cash $6,000 Accounts receivable 19,000 Inventory 16,000 Supplies 1,000 Furniture 40,000 Accumulated depreciation $8,500 Accounts payable 12,000 Salary payable 500 Unearned revenue 8,000 Notes payable, long term 13,500 Common stock 5,000 Retained earnings 34,000 Dividends 42,200 Sales revenue 165,000 Sales returns 7,400 Cost of goods sold 78,000 Selling expense 22,000 General expense 12,500 Interest Expense 2,400 Total $246.500 $246,500 Requirements: R1. Journalize Heartstrings' closing entries. R2. Prepare Heartstrings' single-step income statement for the year. R3. Compute the gross profit percentage and the rate of inventory turnover for 2018. Inventory on hand one year ago, at February 28, 2017, was $12,800. R4. For the year ended February 28, 2017, Heartstrings' gross profit percentage was 51%, and inventory turnover was 5.4 times. Did the results for the year ended February 29, 2018 suggest improvement or deterioration in profitability over last year? 3. The records of Farm Quality Steak Company list the following selected accounts for the quarter ended April 30, 2018:Accounting 1 Handouts Interest Revenue Merchandise Inventory 400 Accounts Payable $ 17,700 38,200 Notes Payable, long-term 45,000 Accounts Receivable Salaries Payable 54,000 Accumulated Depreciation-Equipment 37,700 Net Sales Revenue 2,800 Fisher, Capital 35,380 25,000 Rent Expense (Selling) 298,000 Fisher, Withdrawals 15, 100 Cash 7,100 Salaries Expense (Administrative) 2,000 Cost of Goods Sold 154,960 Office Supplies 132,000 Unearned Revenue 6,500 Equipment Interest Expense 13,100 Interest Payable 1,700 2, 100 Rent Expense (Administrative) 7,100 Depreciation Expense-Equipment (Administrative) 6,000 Utilities Expense (Administrative) 1,320 Salaries Expense (Selling) 10,000 Delivery Expense (Selling) 4,600 Utilities Expense (Selling) 3,800 Requirements: R1. Prepare a multi-step income statement. R2. M. Fisher, owner of the company, strives to earn a gross profit percentage of at least 50%. Did Farm Quality achieve this goal? Show your calculations. Decision Case Jim Mcnamara and Holly Clark opened Game-Time T-Shirts to sell T-shirts for football games at their college. The company completed the first year of operations, and the owners are generally pleased with operating results, as shown by the following income statement: Game-Time T-Shirts Income Statement Year Ended December 31, 2018 Net sales revenue $ 375,000 Cost of goods sold 185,000 Gross margin 190,000 Operating expenses Selling expense 60,000 General expense 30,000 Net income $ 100,000 Mcnamara and Clark are considering how to expand the business. They each propose a way to increase profits to $150,000 during 2019. a. Mcnamara believes they should advertise more heavily. He believes additional advertising costing $25,000 will increase net sales by 30% and leave general expense unchanged. 16 . Clark proposes selling higher-margin merchandise, such as sweatshirts. An importer can supply a minimum of 1,000 sweatshirts for $35 each; Game-Time can mark these sweatshirts up 100% and sell them for $70. Clark realizes they will have to advertise the new merchandise, and this advertising will cost $5,000. Game-Time can expect to sell only 75% of these sweatshirts during the coming year. Requirement: R1. Help Mcnamara and Clark determine which plan to pursue. Prepare a single-step income statement for 2019 to show the expected net income under each plan