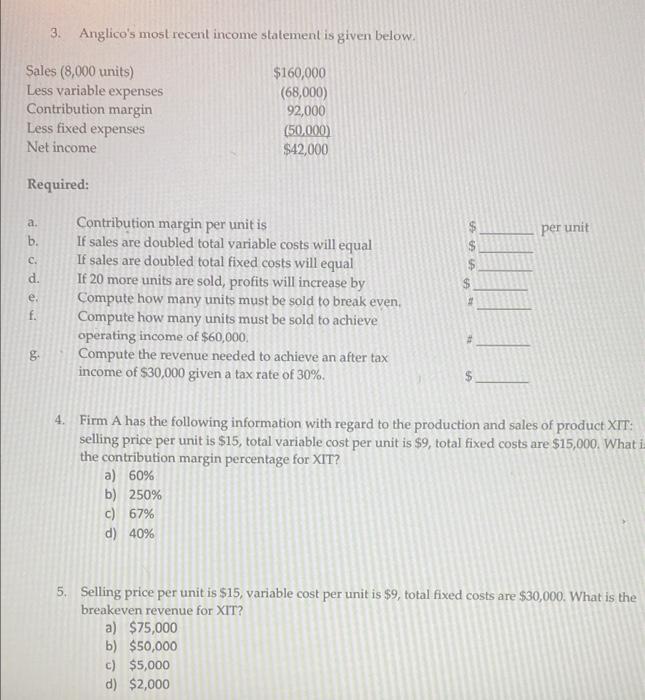

Question: 3. Anglico's most recent income statement is given below. Sales (8,000 units) Less variable expenses Contribution margin Less fixed expenses Net income $160,000 (68,000) 92,000

3. Anglico's most recent income statement is given below. Sales (8,000 units) Less variable expenses Contribution margin Less fixed expenses Net income $160,000 (68,000) 92,000 (50,000) $42,000 Required: a. per unit b. C. $ d. $ e. f. Contribution margin per unit is If sales are doubled total variable costs will equal If sales are doubled total fixed costs will equal If 20 more units are sold, profits will increase by Compute how many units must be sold to break even Compute how many units must be sold to achieve operating income of $60,000 Compute the revenue needed to achieve an after tax income of $30,000 given a tax rate of 30%. g $ 4. Firm A has the following information with regard to the production and sales of product XIT: selling price per unit is $15, total variable cost per unit is $9, total fixed costs are $15,000. What i the contribution margin percentage for XIT? a) 60% b) 250% c) 67% d) 40% 5. Selling price per unit is $15, variable cost per unit is $9, total fixed costs are $30,000. What is the breakeven revenue for XIT? a) $75,000 b) $50,000 c) $5,000 d) $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts