Question: 3) Answer next three questions based on following information. Funny Honey is an unlisted candy company, and its CFO is trying to figure out its

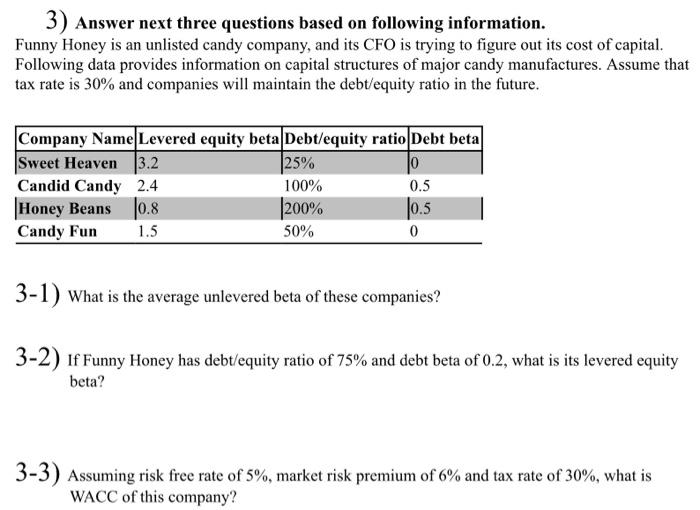

3) Answer next three questions based on following information. Funny Honey is an unlisted candy company, and its CFO is trying to figure out its cost of capital. Following data provides information on capital structures of major candy manufactures. Assume that tax rate is 30% and companies will maintain the debt/equity ratio in the future. Company Name Levered equity beta Debt/equity ratio Debt beta Sweet Heaven 3.2 25% Jo Candid Candy 2.4 100% 0.5 Honey Beans 0.8 200% 10.5 Candy Fun 1.5 50% 0 3-1) What is the average unlevered beta of these companies? 3-2) if Funny Honey has debt/equity ratio of 75% and debt beta of 0.2, what is its levered equity beta? 3-3) Assuming risk free rate of 5%, market risk premium of 6% and tax rate of 30%, what is WACC of this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts