Question: 3) Answer questions in ascending order. Problem 3 ( 6 questions 43 points eacha15%) Questions 1923 are based on the following: A private not-for-profit organization

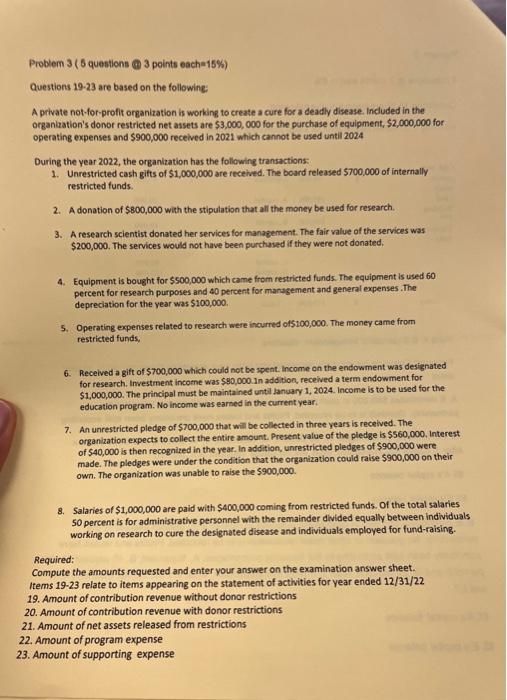

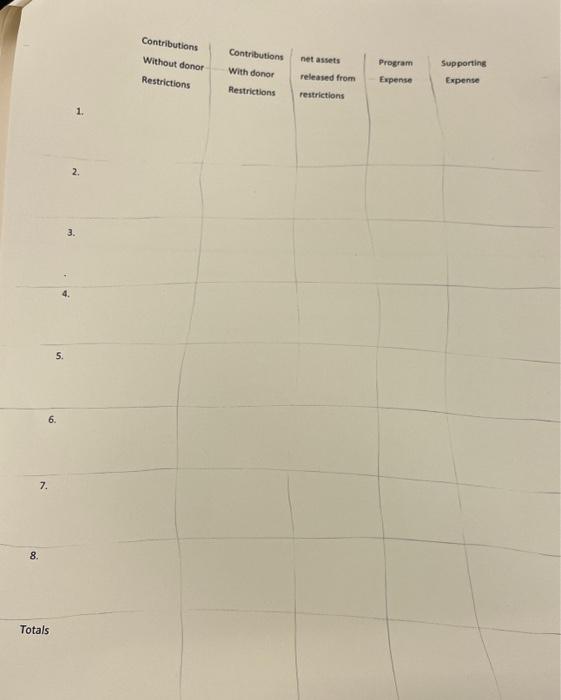

Problem 3 ( 6 questions 43 points eacha15\%) Questions 1923 are based on the following: A private not-for-profit organization is working to create a cure for a deadly disease. Included in the organlation's donor restricted net assets are $3,000,000 for the purchase of equipment, $2,000,000 for: operating expenses and $900,000 received in 2021 which cannot be used until 2024 During the year 2022, the organlzation has the following transactions: 1. Unrestricted cash gifts of $1,000,000 are received. The board released $700,000 of internally restricted funds. 2. A donation of $800,000 with the stipulation that all the money be used for research. 3. A research scientist donated her services for management. The fair value of the services was $200,000. The services would not have been purchased if they were not donated. 4. Equipment is bought for $500,000 which came from restricted funds. The equipment is used 60 percent for research purposes and 40 percent formanagement and general expenses. The depreciation for the year was $100,000. 5. Operating expenses related to research were incurred 015100,000 . The money came from restricted funds. 6. Received a gift of $700,000 which could not be spent. Income on the endowment was designated for research. Investment incoene was $90,000.1n addition, received a term endowment for $1,000,000. The principal must be maintained until January 1,2024 . Income is to be used for the : education program. No income was earned in the current year. 7. An unrestricted pledge of $700,000 that will be collected in three years is received. The organization expects to collect the entire amount. Present value of the pledge is $560,000, Interest of $40,000 is then recognized in the year. In addition, unrestricted pledges of $900,000 were made. The pledges were under the condition that the organization could raise $900,000 on their own. The organization was unable to raise the $900,000. 8. Salaries of $1,000,000 are paid with $400,000 coming from restricted funds. Of the total salaries 50 percent is for administrative personnel with the remainder divided equally between individuals working on research to cure the designated disease and individuals employed for fund-raising. Required; Compute the amounts requested and enter your answer on the examination answer sheet. Items 1923 relate to items appearing on the statement of activities for year ended 12/31/22 19. Amount of contribution revenue without donor restrictions 20. Amount of contribution revenue with donor restrictions 21. Amount of net assets released from restrictions 22. Amount of program expense 23. Amount of supporting expense Contributions \begin{tabular}{|l|l|c|c|} \hline Contributions & net assets & Program & Supporting \\ \hline Pestrictions & restrictions & & \\ & & \end{tabular} 2. 3. 5. 6. 7. 8. Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts