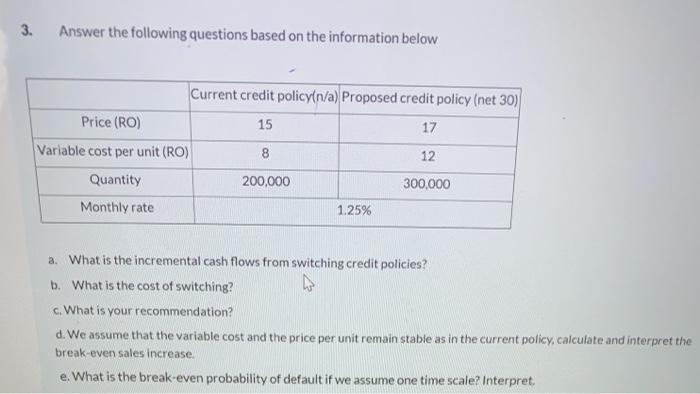

Question: 3. Answer the following questions based on the information below Current credit policy(n/a) Proposed credit policy (net 30) Price (RO) 15 17 Variable cost per

3. Answer the following questions based on the information below Current credit policy(n/a) Proposed credit policy (net 30) Price (RO) 15 17 Variable cost per unit (RO) 8 12 Quantity 200,000 300,000 Monthly rate 1.25% a. What is the incremental cash flows from switching credit policies? b. What is the cost of switching? w c. What is your recommendation? d. We assume that the variable cost and the price per unit remain stable as in the current policy, calculate and interpret the break-even sales increase. e. What is the break-even probability of default if we assume one time scale? Interpret

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts