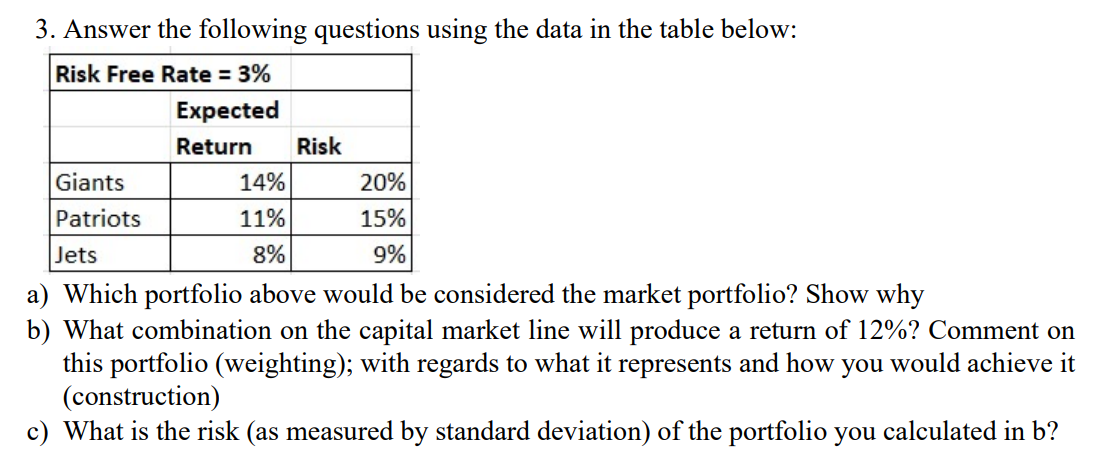

Question: 3. Answer the following questions using the data in the table below: Risk Free Rate = 3% Expected Return Risk Giants 14% 20% Patriots 11%

3. Answer the following questions using the data in the table below: Risk Free Rate = 3% Expected Return Risk Giants 14% 20% Patriots 11% 15% Jets 8% 9% a) Which portfolio above would be considered the market portfolio? Show why b) What combination on the capital market line will produce a return of 12%? Comment on this portfolio (weighting); with regards to what it represents and how you would achieve it (construction) c) What is the risk (as measured by standard deviation) of the portfolio you calculated in b? 3. Answer the following questions using the data in the table below: Risk Free Rate = 3% Expected Return Risk Giants 14% 20% Patriots 11% 15% Jets 8% 9% a) Which portfolio above would be considered the market portfolio? Show why b) What combination on the capital market line will produce a return of 12%? Comment on this portfolio (weighting); with regards to what it represents and how you would achieve it (construction) c) What is the risk (as measured by standard deviation) of the portfolio you calculated in b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts