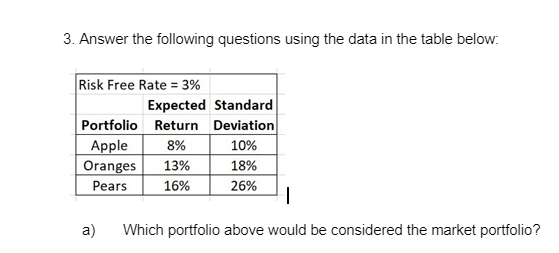

Question: 3. Answer the following questions using the data in the table below: Risk Free Rate = 3% Expected Standard Portfolio Return Deviation Apple 8% 10%

3. Answer the following questions using the data in the table below: Risk Free Rate = 3% Expected Standard Portfolio Return Deviation Apple 8% 10% Oranges 13% 18% Pears 16% 26% a) Which portfolio above would be considered the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts