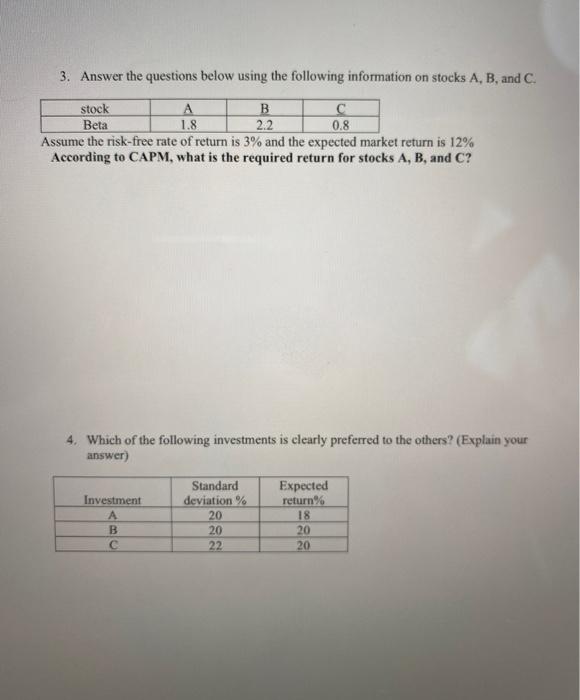

Question: 3. Answer the questions below using the following information on stocks A, B, and C. 1.8 stock A B C Beta 2.2 0.8 Assume the

3. Answer the questions below using the following information on stocks A, B, and C. 1.8 stock A B C Beta 2.2 0.8 Assume the risk-free rate of return is 3% and the expected market return is 12% According to CAPM, what is the required return for stocks A, B, and C? 4. Which of the following investments is clearly preferred to the others? (Explain your answer) Standard Expected Investment deviation% return% A 20 18 20 20 22 20 B C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts