Question: 3. Assume the annualized, continuously compounded return on Ford stock is normally distributed with mean .1952 and standard deviation of .36464. Also the annualized, continuously

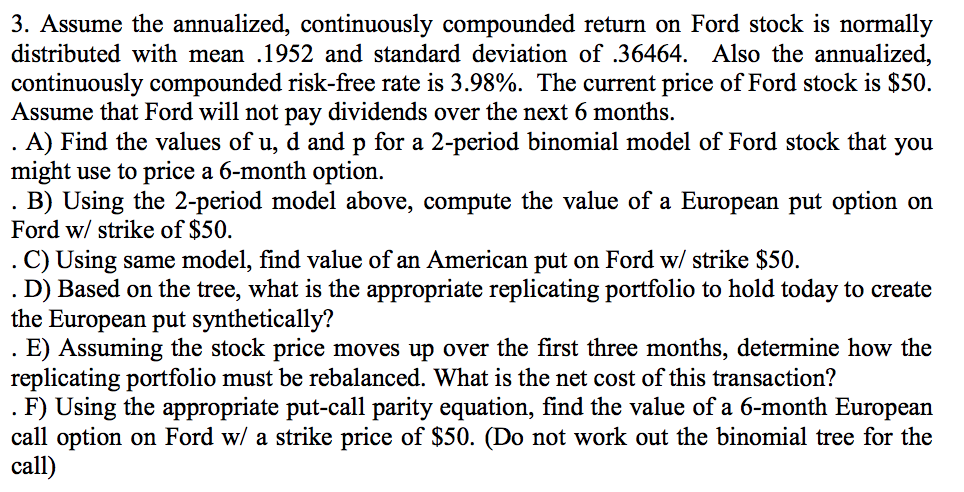

3. Assume the annualized, continuously compounded return on Ford stock is normally distributed with mean .1952 and standard deviation of .36464. Also the annualized, continuously compounded risk-free rate is 3.98%. The current price of Ford stock is $50. Assume that Ford will not pay dividends over the next 6 months. A) Find the values of u, d and p for a 2-period binomial model of Ford stock that you B) Using the 2-period model above, compute the value of a European put option on C) Using same model, find value of an American put on Ford w/ strike $50. might use to price a 6-month option. Ford w/ strike of $50 D) Based on the tree, what is the appropriate replicating portfolio to hold today to create E) Assuming the stock price moves up over the first three months, determine how the F) Using the appropriate put-call parity equation, find the value of a 6-month European the European put synthetically? replicating portfolio must be rebalanced. What is the net cost of this transaction'? call option on Ford w/ a strike price of $50. (Do not work out the binomial tree for the call 3. Assume the annualized, continuously compounded return on Ford stock is normally distributed with mean .1952 and standard deviation of .36464. Also the annualized, continuously compounded risk-free rate is 3.98%. The current price of Ford stock is $50. Assume that Ford will not pay dividends over the next 6 months. A) Find the values of u, d and p for a 2-period binomial model of Ford stock that you B) Using the 2-period model above, compute the value of a European put option on C) Using same model, find value of an American put on Ford w/ strike $50. might use to price a 6-month option. Ford w/ strike of $50 D) Based on the tree, what is the appropriate replicating portfolio to hold today to create E) Assuming the stock price moves up over the first three months, determine how the F) Using the appropriate put-call parity equation, find the value of a 6-month European the European put synthetically? replicating portfolio must be rebalanced. What is the net cost of this transaction'? call option on Ford w/ a strike price of $50. (Do not work out the binomial tree for the call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts