Question: 3. Assuming we begin a project, which has the same OCFS and WACC as those in this company. You spend $4,000,000 to begin a

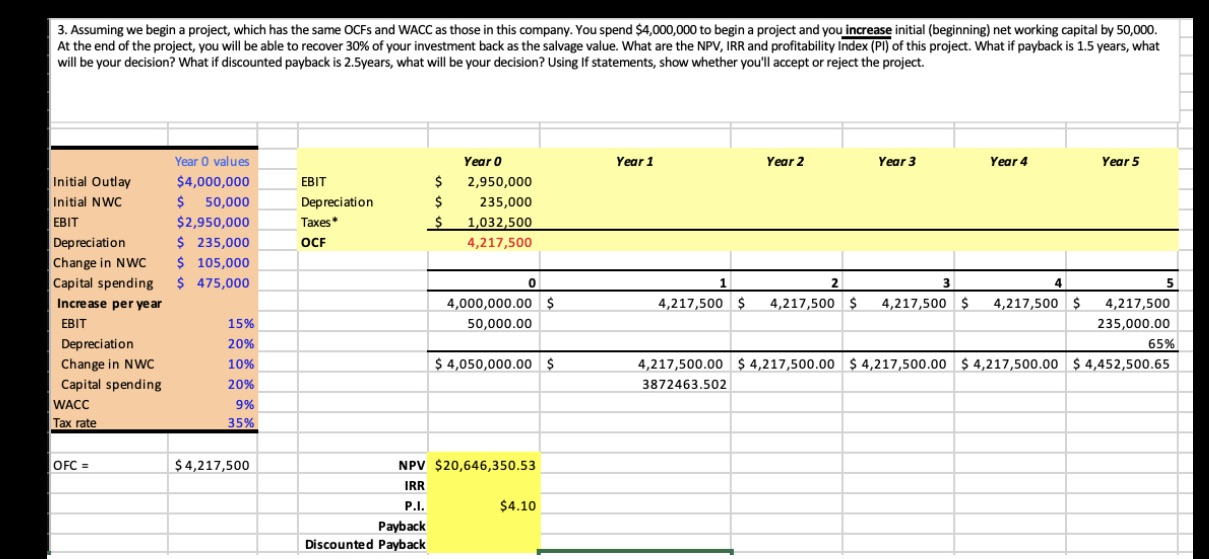

3. Assuming we begin a project, which has the same OCFS and WACC as those in this company. You spend $4,000,000 to begin a project and you increase initial (beginning) net working capital by 50,000. At the end of the project, you will be able to recover 30% of your investment back as the salvage value. What are the NPV, IRR and profitability Index (PI) of this project. What if payback is 1.5 years, what will be your decision? What if discounted payback is 2.5years, what will be your decision? Using If statements, show whether you'll accept or reject the project. Initial Outlay Initial NWC EBIT Year O values $4,000,000 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 EBIT $ 2,950,000 $ 50,000 $2,950,000 Depreciation Change in NWC $ 235,000 $ 105,000 Depreciation Taxes* OCF $ 235,000 $ 1,032,500 4,217,500 Capital spending $ 475,000 0 Increase per year EBIT 15% Depreciation 20% Change in NWC 10% Capital spending 20% 1 2 3 4 5 4,000,000.00 $ 50,000.00 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 $ 4,217,500 235,000.00 65% $4,050,000.00 $ 4,217,500.00 $4,217,500.00 $4,217,500.00 $4,217,500.00 $4,452,500.65 3872463.502 WACC 9% Tax rate 35% OFC= $4,217,500 NPV $20,646,350.53 IRR P.I. Payback Discounted Payback $4.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts