Question: 3. ASU Construction Company has a contract to construct a $5,000,000 stadium at an estimated cost of $4,250,000. The contract starts in 2018, and the

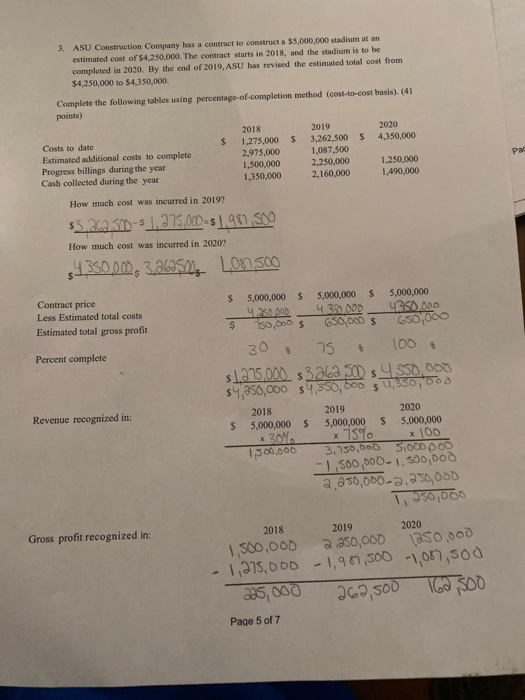

3. ASU Construction Company has a contract to construct a $5,000,000 stadium at an estimated cost of $4,250,000. The contract starts in 2018, and the stadium is to be completed in 2020. By the end of 2019, ASU has revised the estimated total cost from $4,250,000 to $4,350,000 Complete the following tables using percentage-of-completion method (cost-to-cost basis). (41 points) 2018 2019 2020 Costs to date s 1,275,000 $ 3,262,500 $ 4,350,000 Estimated additional costs to complete 2,975.000 1.087.500 Progress billings during the year 1,500,000 2,250,000 1,250,000 Cash collected during the year 1,350,000 2,160,000 1,490,000 Pac How much cost was incurred in 20197 $3.20250 -$ 1,275,00-5 1.901.500 $435000, 3.26350 , LOOSCO How much cost was incurred in 2020? S $ Contract price Less Estimated total costs Estimated total gross profit $ 30 100 Percent complete $ 5,000,000 5,000,000 S 5.000.000 4.25.000 4 300DD U250.000 150,000 $ 650,000 $ 650,000 75 s1215,000 $3ala so s 550.000 $4,250,000 $9,350,000 0,350,000 2018 2019 2020 $ 5,000,000 $ 5,000,000 S 5,000,000 * 30110 x 750 1,500,000 3,750,000 5,000 DOO -1,500,000 - 1.500,000 2,250,000 -2,250,000 T, 250,000 Revenue recognized in: x 100 2018 2020 Gross profit recognized in: 2019 1,500,000 2.250,000 150,000 1,275,000 -1,987,500 1,000, 500 205,000 263,500 16a 500 Page 5 of 7 Prepare journal entries for the following years. You may do this on the next page. (26 points) 2018 2019 2020 Page 5 of 7 3. ASU Construction Company has a contract to construct a $5,000,000 stadium at an estimated cost of $4,250,000. The contract starts in 2018, and the stadium is to be completed in 2020. By the end of 2019, ASU has revised the estimated total cost from $4,250,000 to $4,350,000 Complete the following tables using percentage-of-completion method (cost-to-cost basis). (41 points) 2018 2019 2020 Costs to date s 1,275,000 $ 3,262,500 $ 4,350,000 Estimated additional costs to complete 2,975.000 1.087.500 Progress billings during the year 1,500,000 2,250,000 1,250,000 Cash collected during the year 1,350,000 2,160,000 1,490,000 Pac How much cost was incurred in 20197 $3.20250 -$ 1,275,00-5 1.901.500 $435000, 3.26350 , LOOSCO How much cost was incurred in 2020? S $ Contract price Less Estimated total costs Estimated total gross profit $ 30 100 Percent complete $ 5,000,000 5,000,000 S 5.000.000 4.25.000 4 300DD U250.000 150,000 $ 650,000 $ 650,000 75 s1215,000 $3ala so s 550.000 $4,250,000 $9,350,000 0,350,000 2018 2019 2020 $ 5,000,000 $ 5,000,000 S 5,000,000 * 30110 x 750 1,500,000 3,750,000 5,000 DOO -1,500,000 - 1.500,000 2,250,000 -2,250,000 T, 250,000 Revenue recognized in: x 100 2018 2020 Gross profit recognized in: 2019 1,500,000 2.250,000 150,000 1,275,000 -1,987,500 1,000, 500 205,000 263,500 16a 500 Page 5 of 7 Prepare journal entries for the following years. You may do this on the next page. (26 points) 2018 2019 2020 Page 5 of 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts