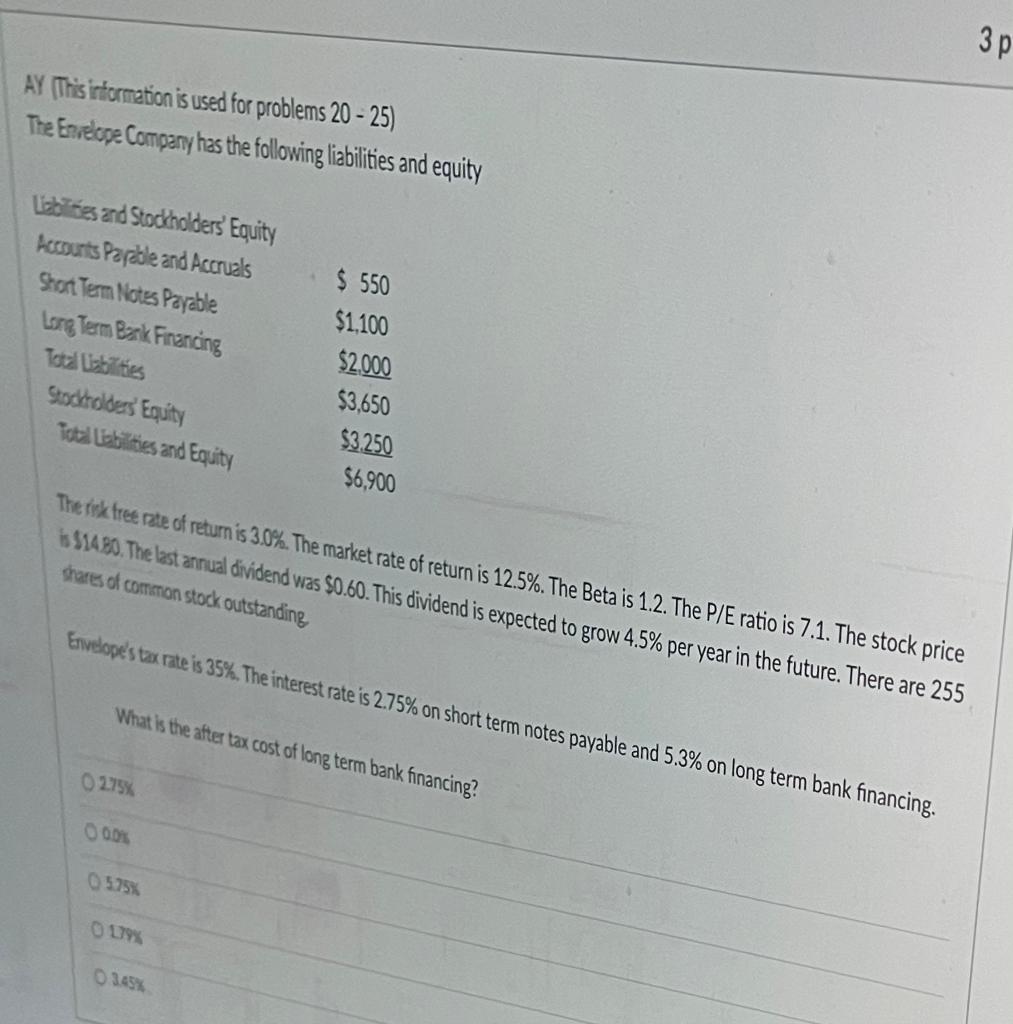

Question: 3 AY (This information is used for problems 20-25) The Envelope Company has the following liabilities and equity bites and Stoholders Equity Ressounts Pardle and

3 AY (This information is used for problems 20-25) The Envelope Company has the following liabilities and equity bites and Stoholders Equity Ressounts Pardle and Accruals Short Term Notes Payable Long Term Bak Financing Totabilities Sokoldes Equity Tbilities and Equity $ 550 $1.100 $2.000 $3,650 $3,250 $6,900 The tek tree rate of return is 3.0%. The market rate of return is 12.5%. The Beta is 1.2. The P/E ratio is 7.1. The stock price 51480. The last annual dividend was $0.60. This dividend is expected to grow 4.5% per year in the future. There are 255 shares of common stock outstanding Envelope's tax rate is 35%. The interest rate is 2.75% on short term notes payable and 5.3% on long term bank financing. What is the after tax cost of long term bank financing? 0275% 0575% 09 3.43%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts