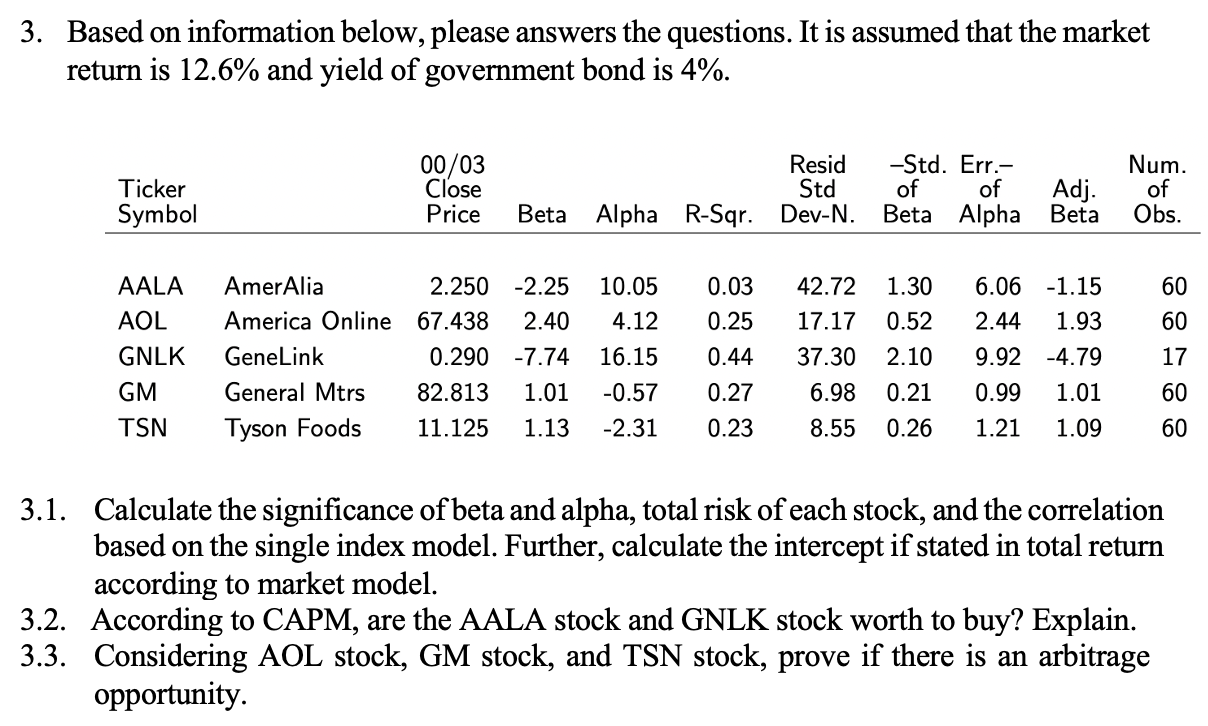

Question: 3. Based on information below, please answers the questions. It is assumed that the market return is 12.6% and yield of government bond is 4%.

3. Based on information below, please answers the questions. It is assumed that the market return is 12.6% and yield of government bond is 4%. 3.1. Calculate the significance of beta and alpha, total risk of each stock, and the correlation based on the single index model. Further, calculate the intercept if stated in total return according to market model. 3.2. According to CAPM, are the AALA stock and GNLK stock worth to buy? Explain. 3.3. Considering AOL stock, GM stock, and TSN stock, prove if there is an arbitrage opportunity. 3. Based on information below, please answers the questions. It is assumed that the market return is 12.6% and yield of government bond is 4%. 3.1. Calculate the significance of beta and alpha, total risk of each stock, and the correlation based on the single index model. Further, calculate the intercept if stated in total return according to market model. 3.2. According to CAPM, are the AALA stock and GNLK stock worth to buy? Explain. 3.3. Considering AOL stock, GM stock, and TSN stock, prove if there is an arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts