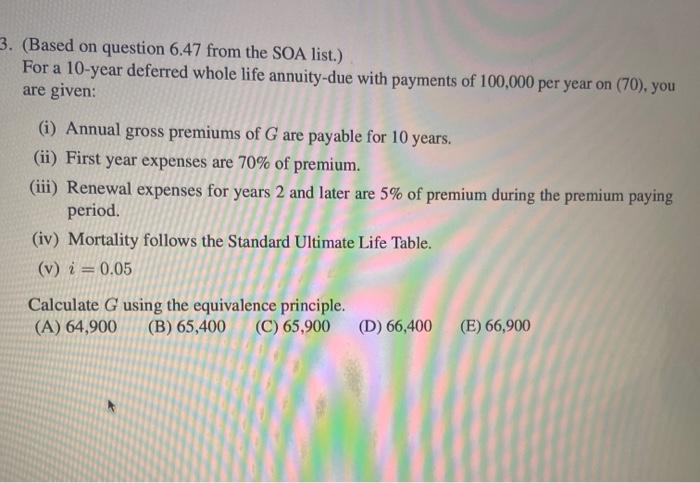

Question: 3. (Based on question 6.47 from the SOA list.) For a 10-year deferred whole life annuity-due with payments of 100,000 per year on (70), you

3. (Based on question 6.47 from the SOA list.) For a 10-year deferred whole life annuity-due with payments of 100,000 per year on (70), you are given: (i) Annual gross premiums of G are payable for 10 years. (ii) First year expenses are 70% of premium. (iii) Renewal expenses for years 2 and later are 5% of premium during the premium paying period. (iv) Mortality follows the Standard Ultimate Life Table. (v) i = 0.05 Calculate G using the equivalence principle. (A) 64,900 (B) 65,400 (C) 65,900 (D) 66,400 (E) 66,900 3. (Based on question 6.47 from the SOA list.) For a 10-year deferred whole life annuity-due with payments of 100,000 per year on (70), you are given: (i) Annual gross premiums of G are payable for 10 years. (ii) First year expenses are 70% of premium. (iii) Renewal expenses for years 2 and later are 5% of premium during the premium paying period. (iv) Mortality follows the Standard Ultimate Life Table. (v) i = 0.05 Calculate G using the equivalence principle. (A) 64,900 (B) 65,400 (C) 65,900 (D) 66,400 (E) 66,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts