Question: 3. Based on the returns on two different assets A and B, suggest a portfolio that will have the least possible risk and greatest

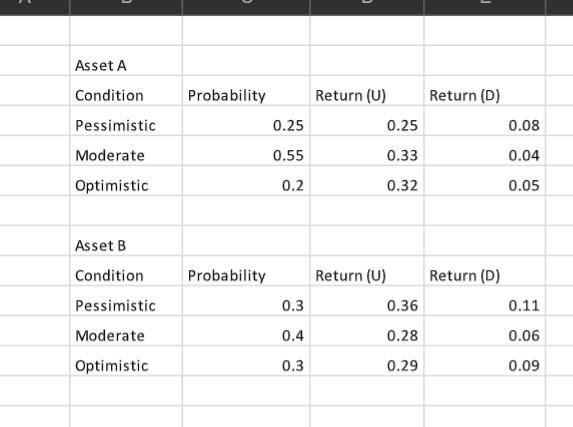

3. Based on the returns on two different assets A and B, suggest a portfolio that will have the least possible risk and greatest return. If the expected market return is 1.5 times the return on highest return in assets and the risk-free rate is 0.75 times the return on lowest return in assets. Suggest the portfolio Sharpe Ratio. Suggest the coefficient of variation to proof the weight allocation. (Use Sheet 2 for this problem) Asset A Condition Pessimistic Moderate Optimistic Asset B Condition Pessimistic Moderate Optimistic Probability Probability 0.25 0.55 0.2 0.3 0.4 0.3 Return (U) 0.25 0.33 0.32 Return (U) 0.36 0.28 0.29 Return (D) Return (D) 0.08 0.04 0.05 0.11 0.06 0.09

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Answer The Sharpe Ratio may be used to identify the ideal portfolio with the lowest risk and highest return The Sharpe Ratio is a gauge of riskadjuste... View full answer

Get step-by-step solutions from verified subject matter experts