Question: 3. Based on the two Efficient Frontiers' assessments, list the lowest risk and highest return portfolio of each portfolio asset combination. What are their percentage

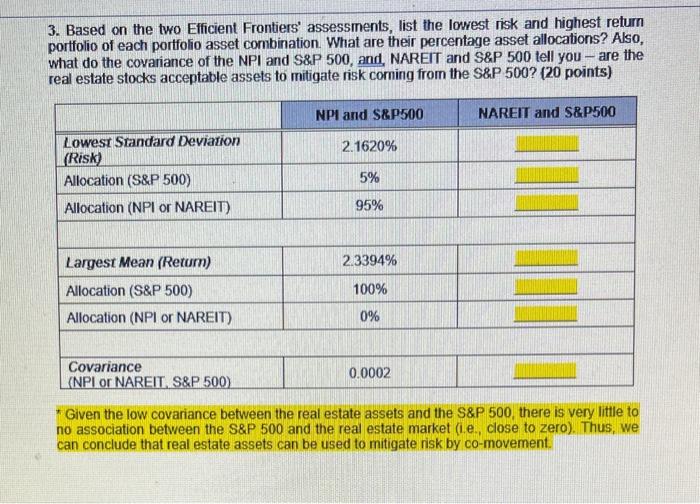

3. Based on the two Efficient Frontiers' assessments, list the lowest risk and highest return portfolio of each portfolio asset combination. What are their percentage asset allocations? Also, what do the covariance of the NPI and S8P 500, and, NAREIT and S\&P 500 tell you - are the real estate stocks acceptable assets to mitigate risk corning from the S8P 500 ? (20 points) * Given the low covariance between the real estate assets and the S\&P 500, there is very little to no association between the S\&P 500 and the real estate market (i.e., close to zero). Thus, we can conclude that real estate assets can be used to mitigate risk by co-movement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts