Question: 3: Bridgeport Note: Please review each drop down and provide correct drop down selection and correct values in fields. Current Attempt in Progress Shown below

3: Bridgeport

Note: Please review each drop down and provide correct drop down selection and correct values in fields.

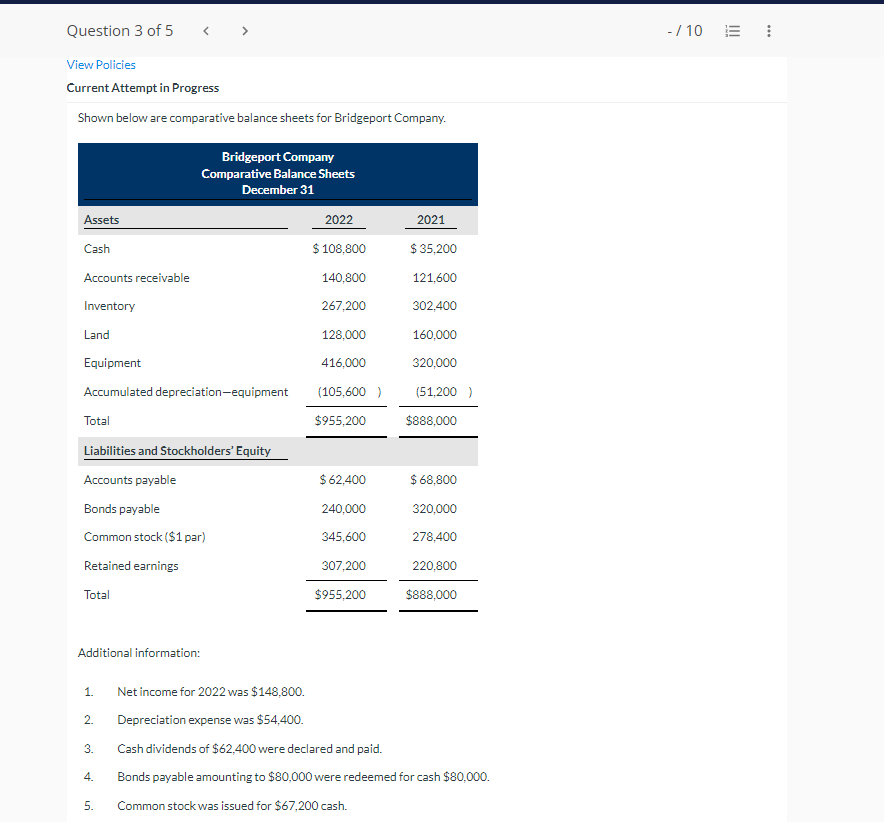

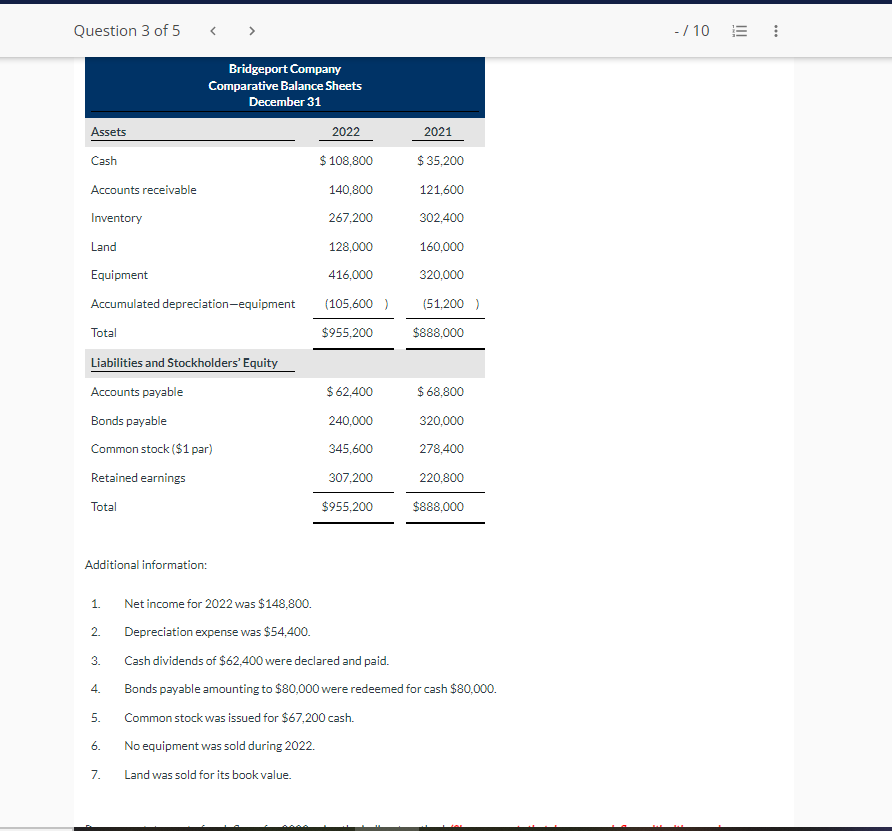

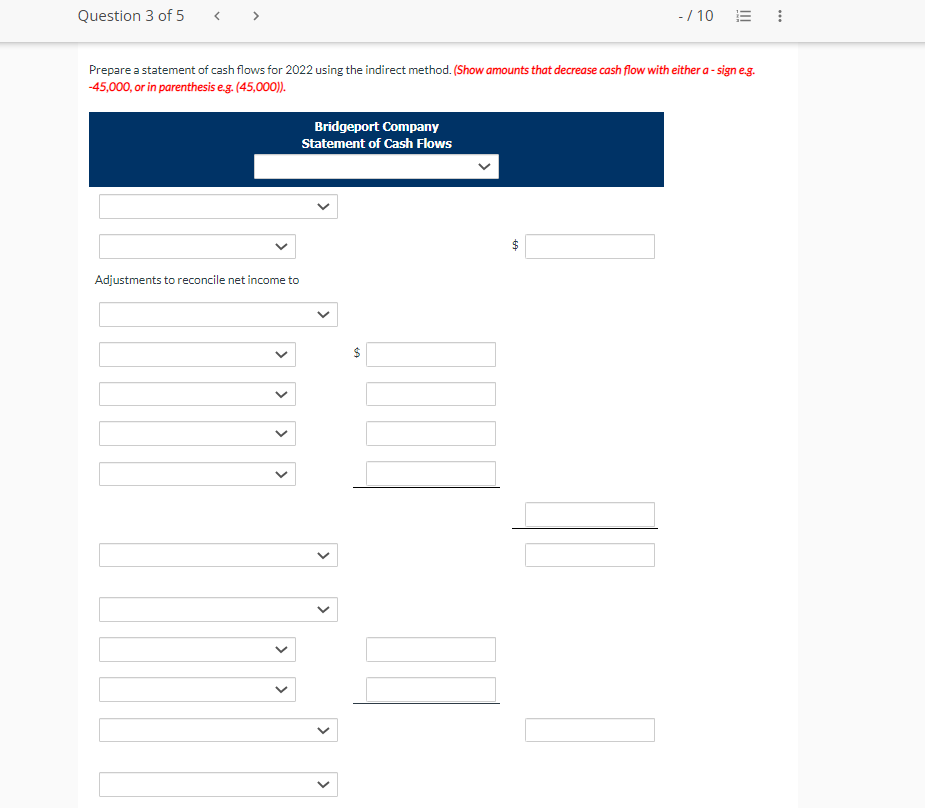

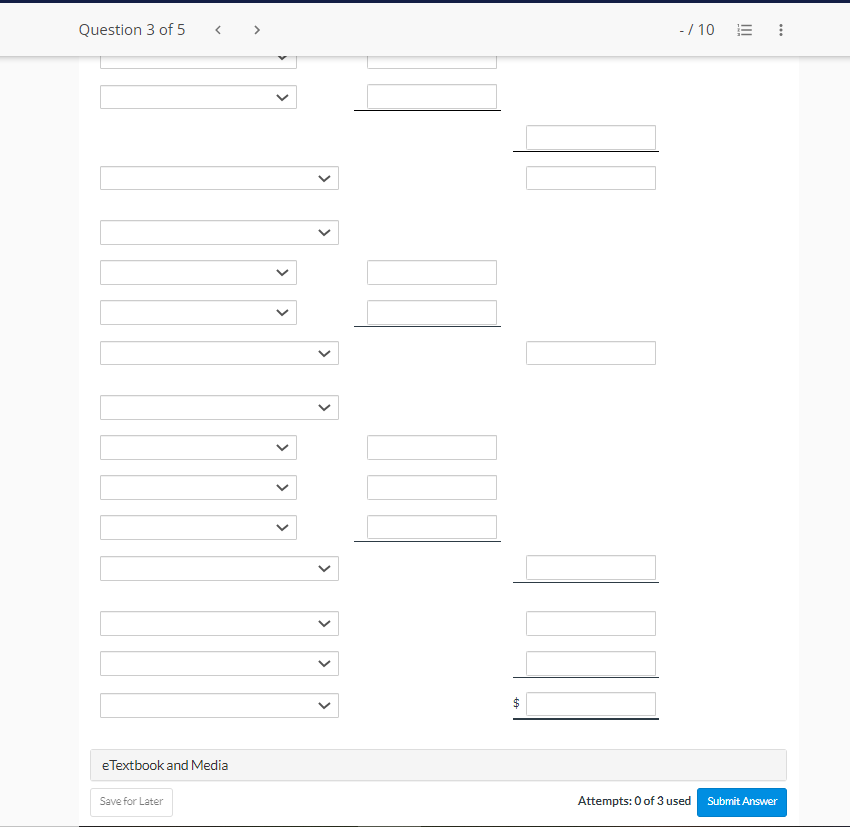

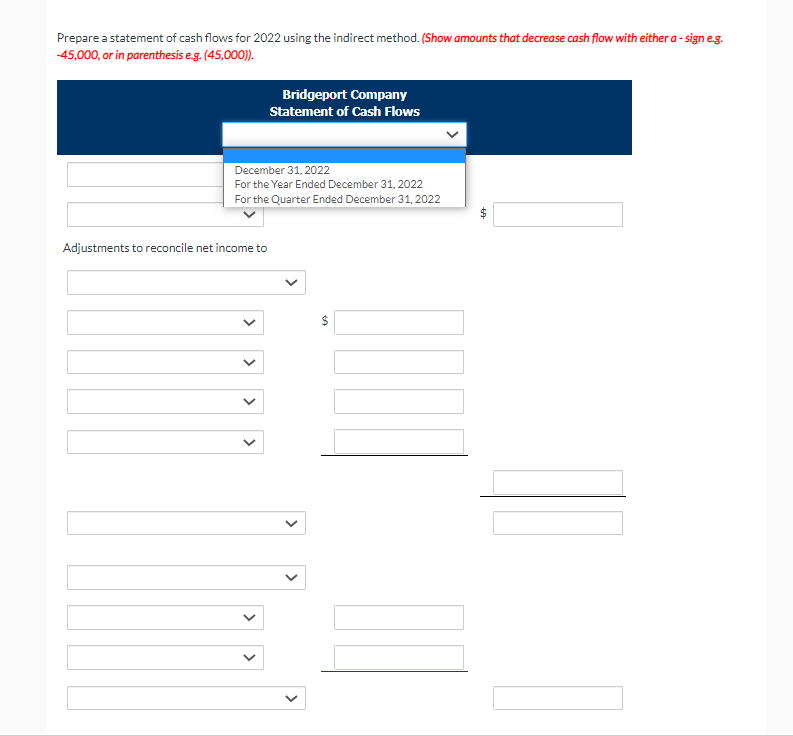

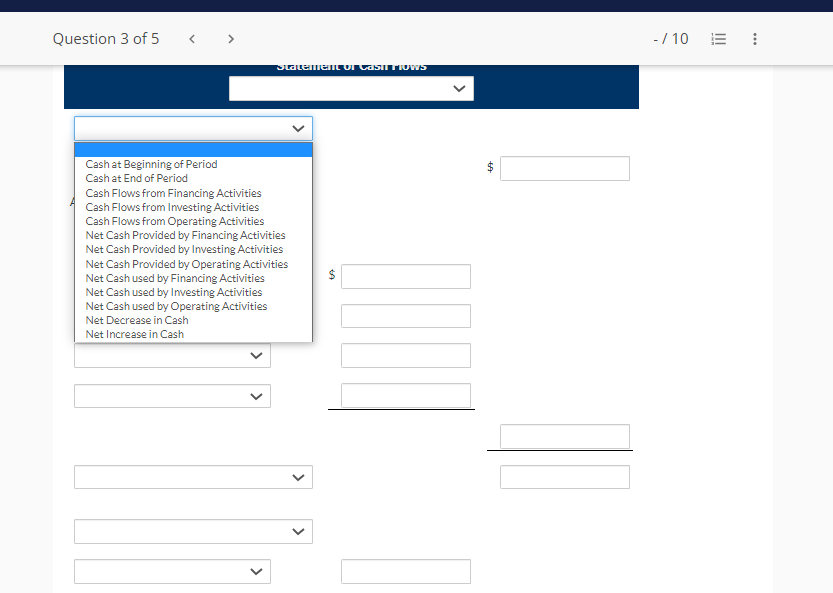

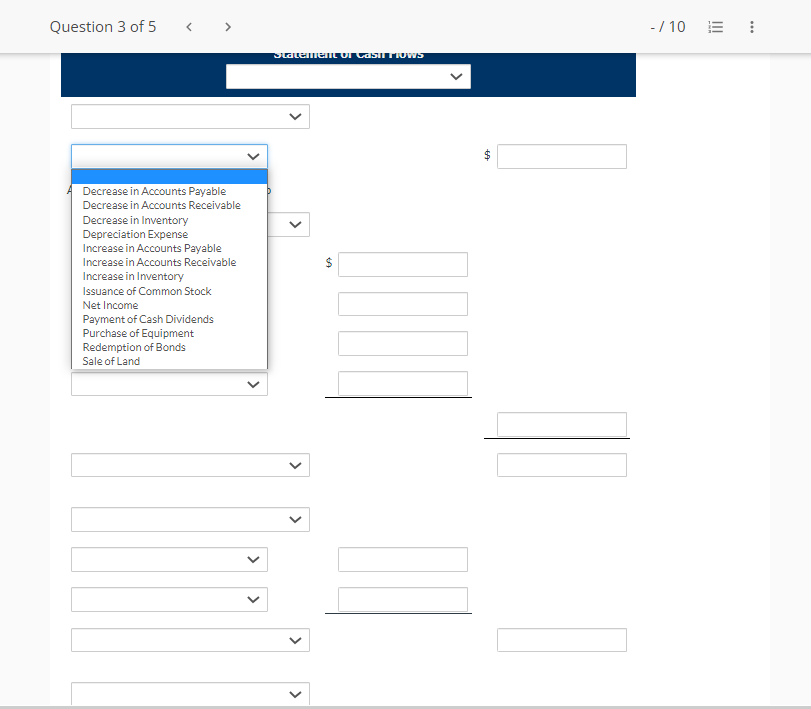

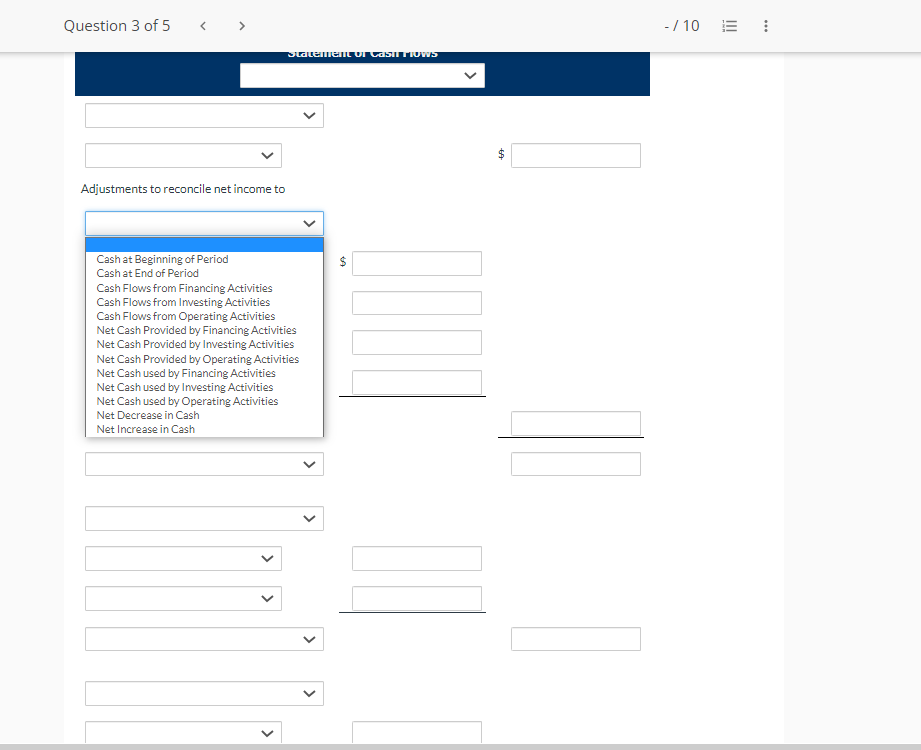

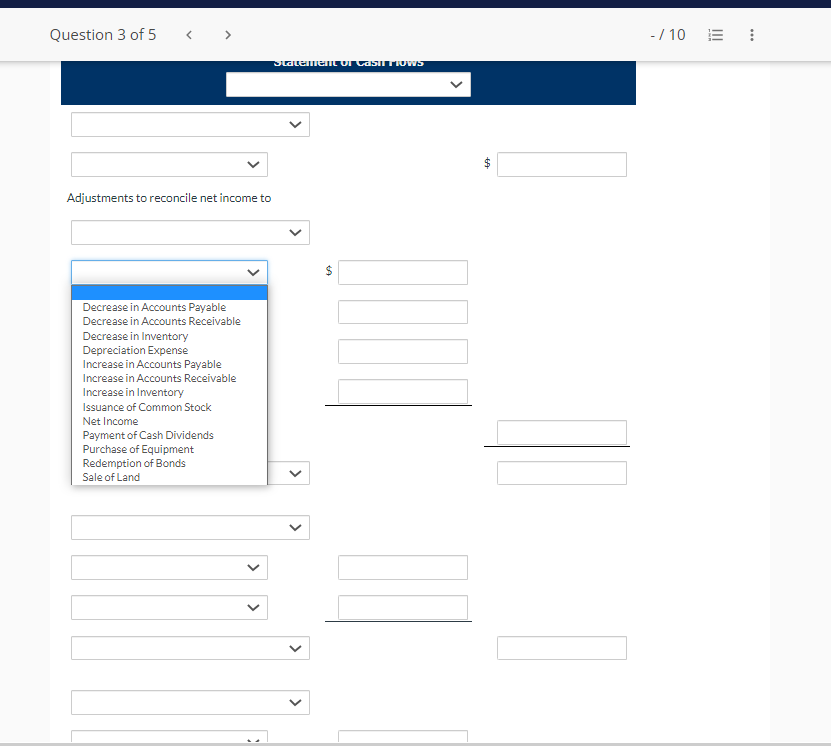

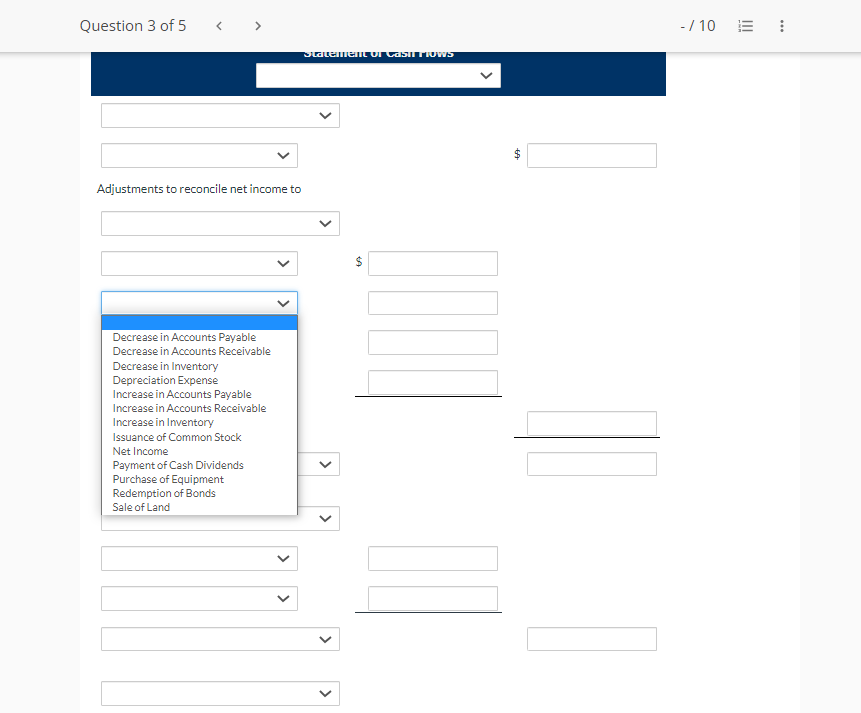

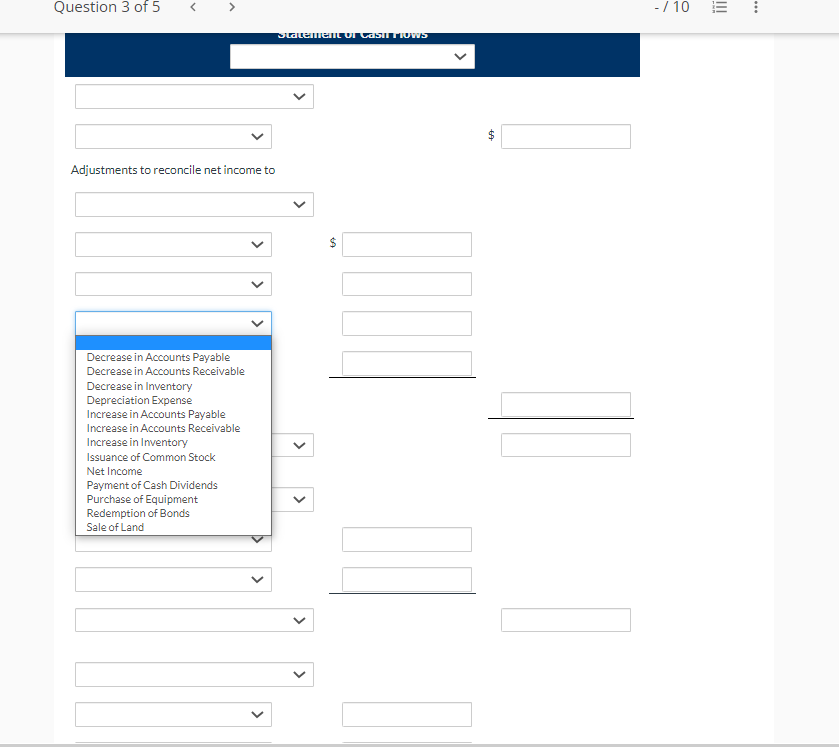

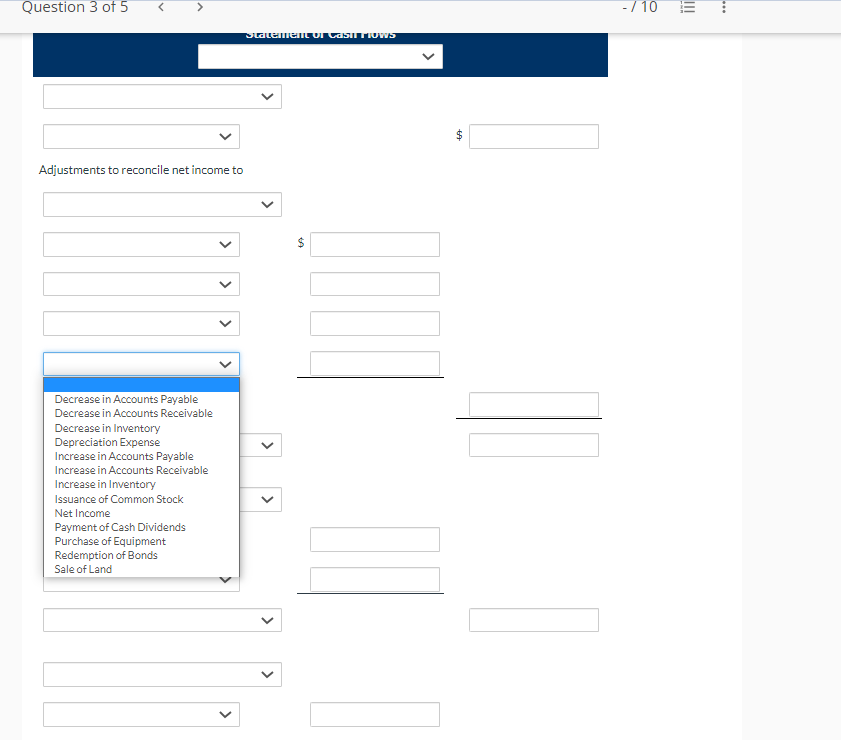

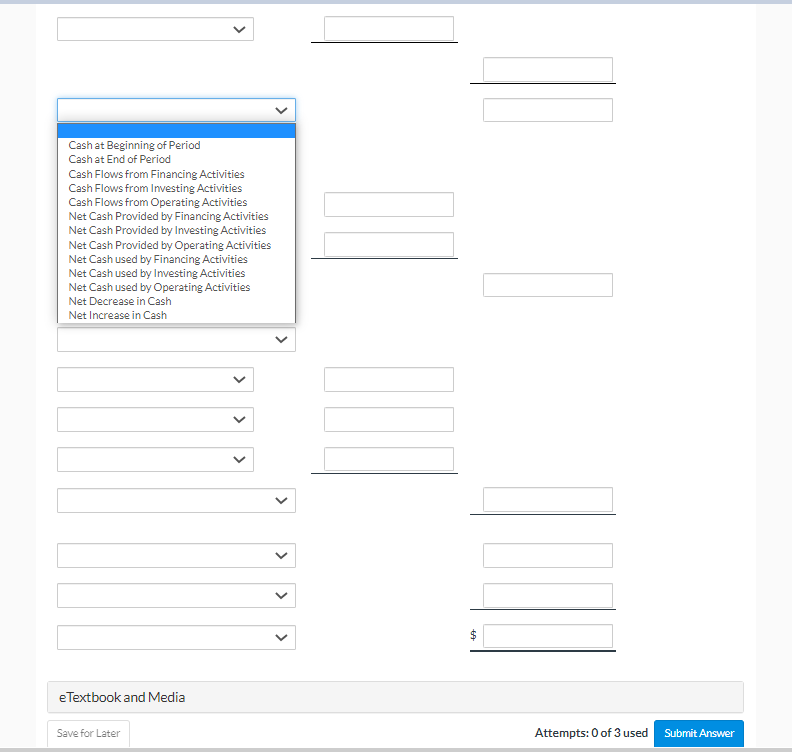

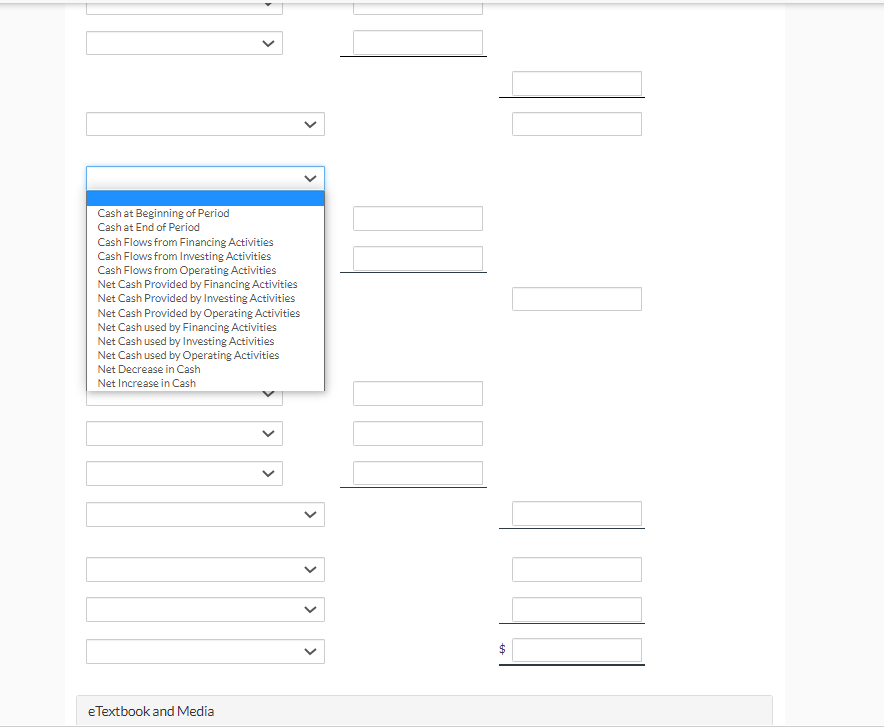

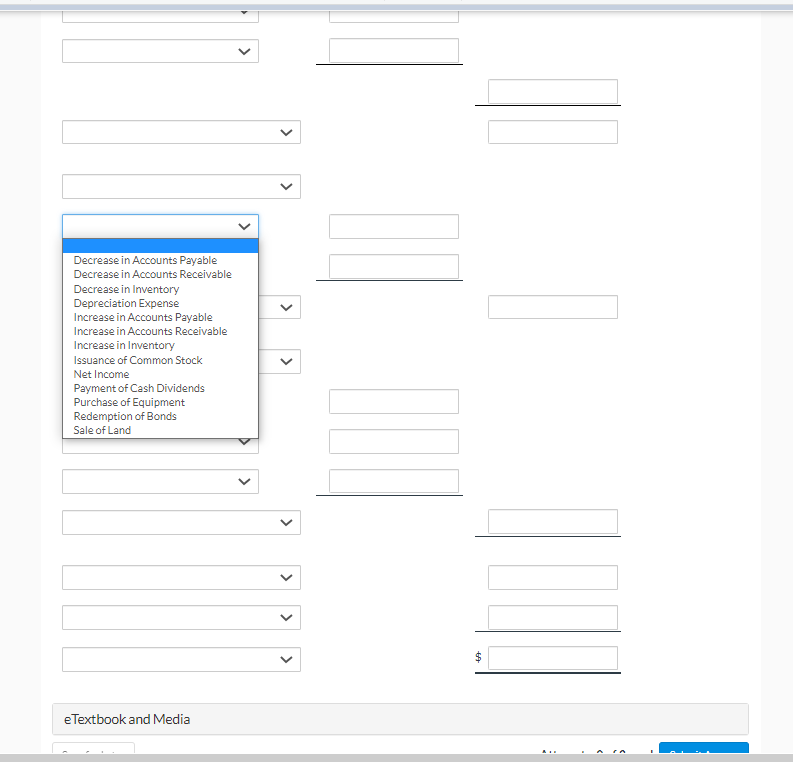

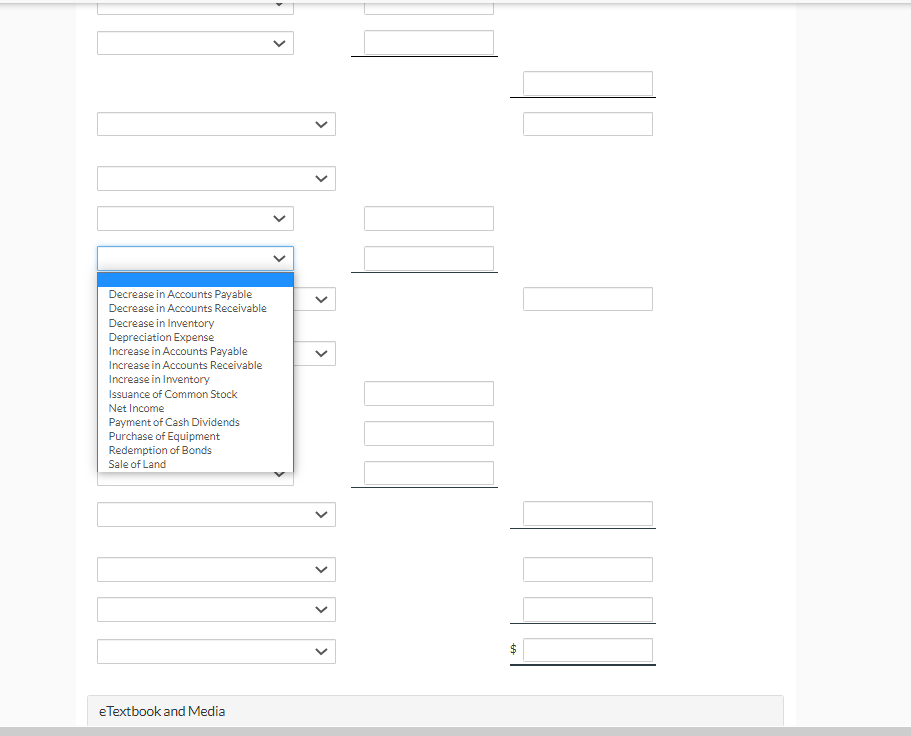

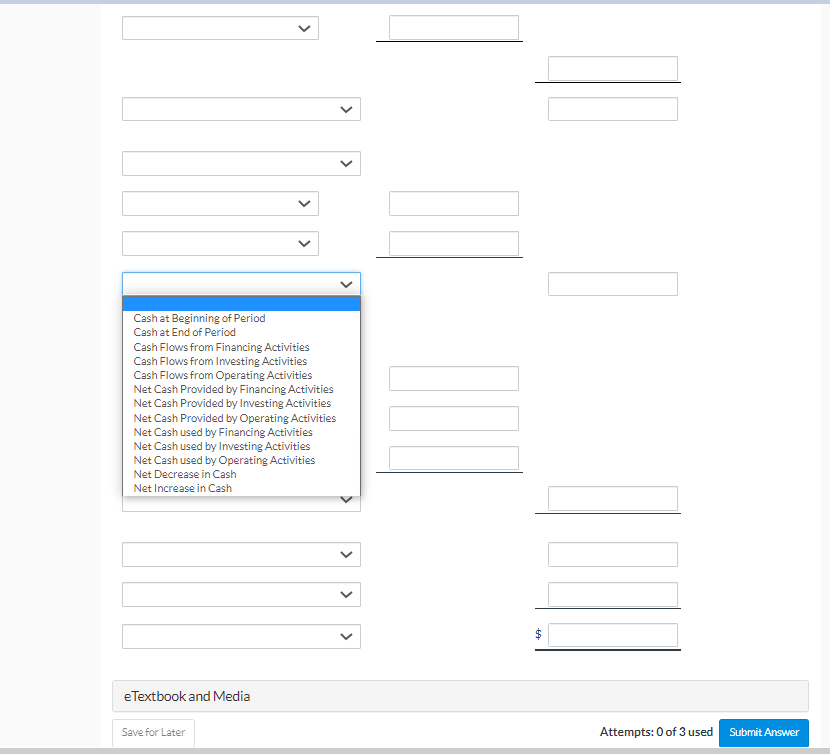

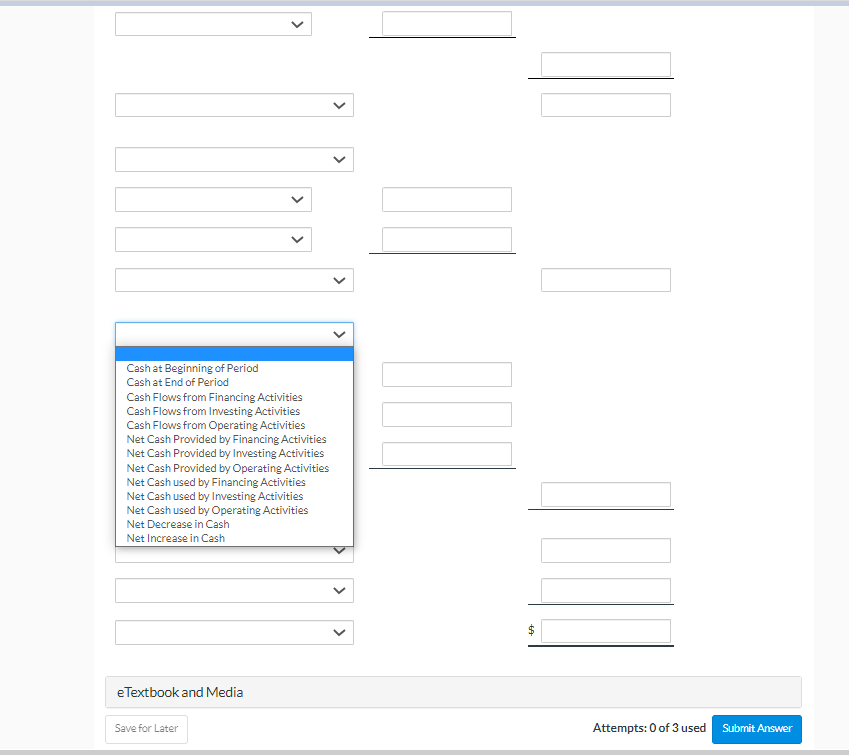

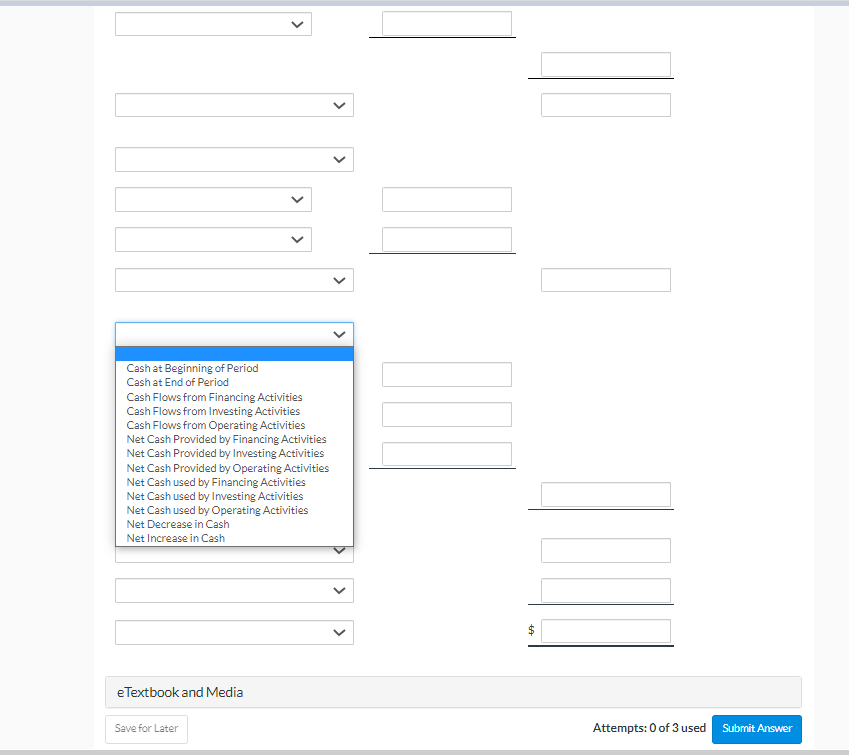

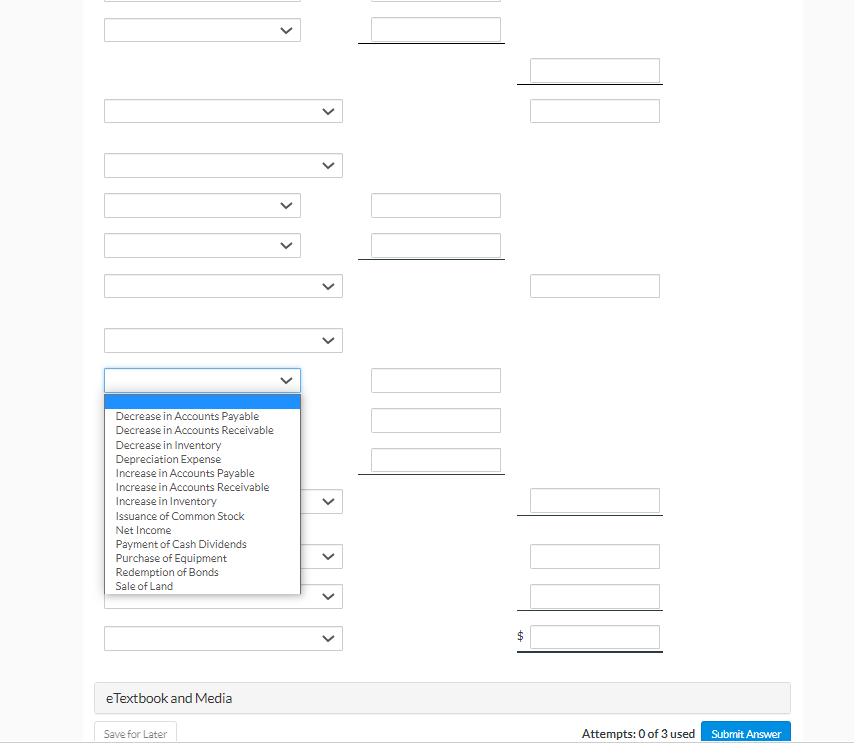

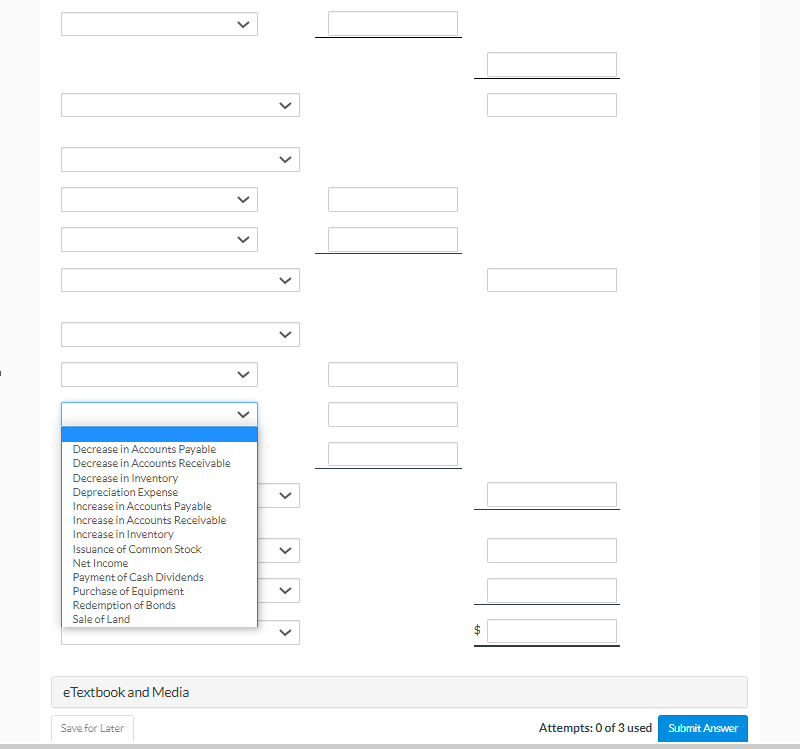

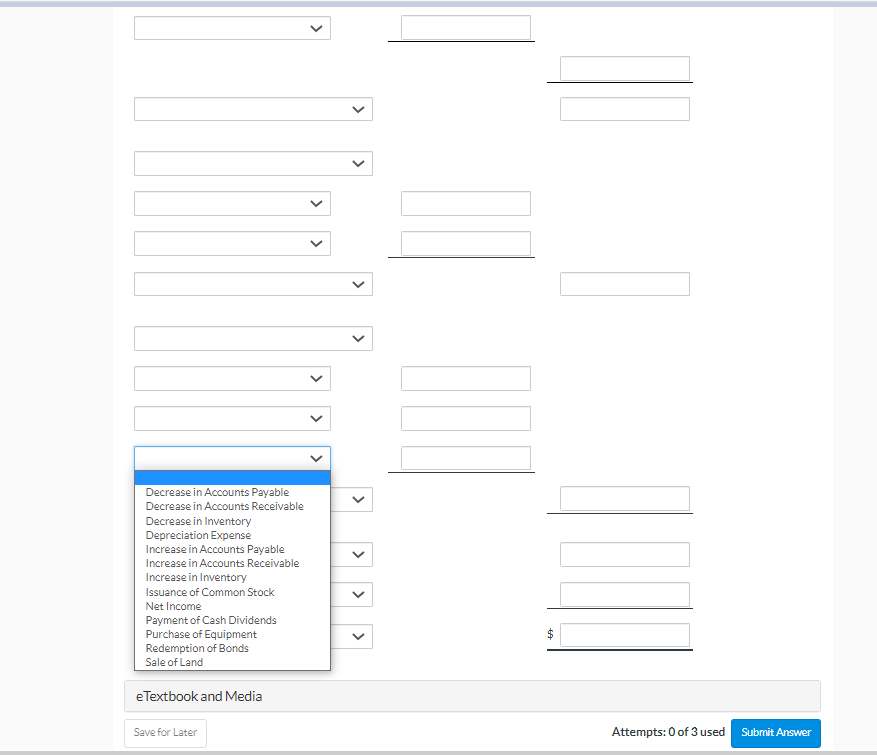

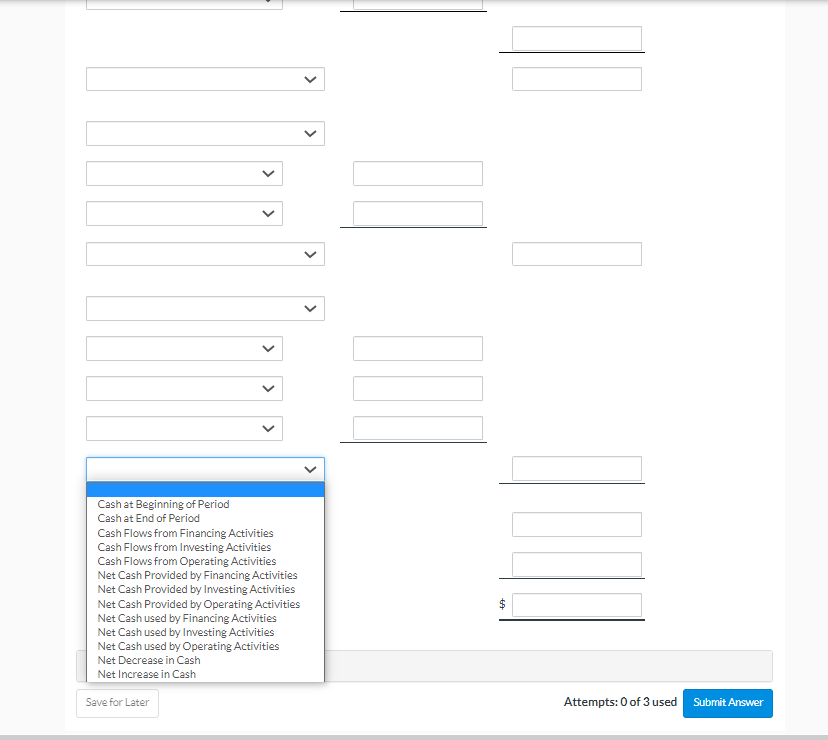

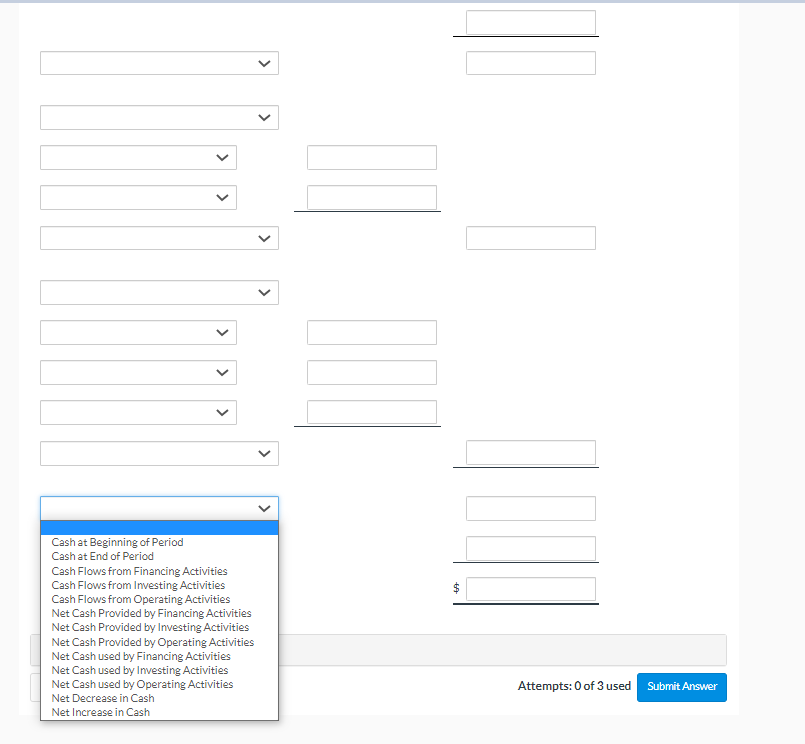

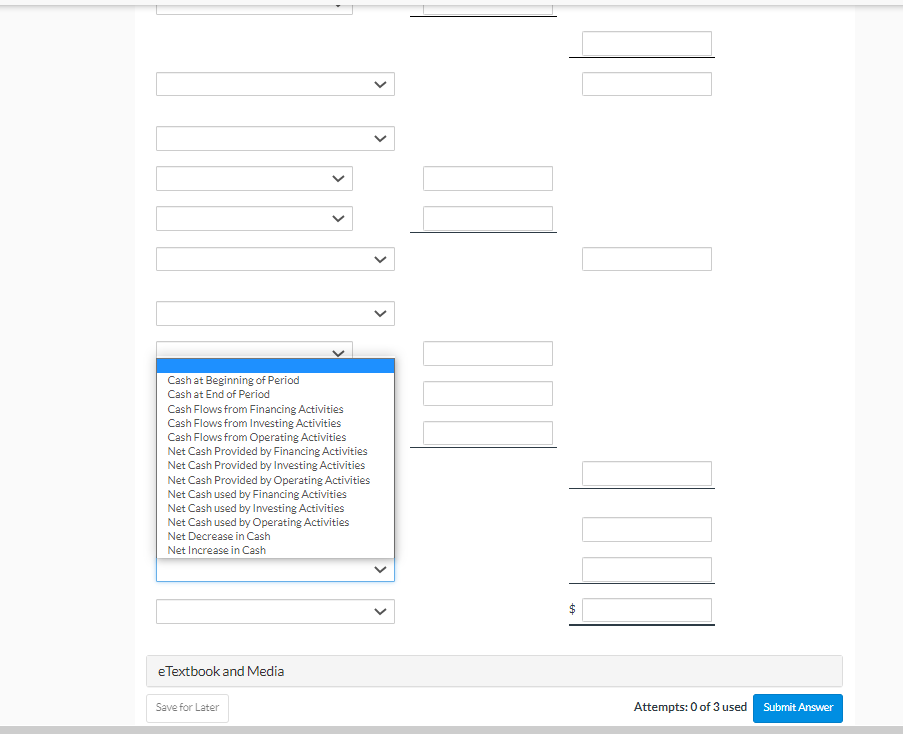

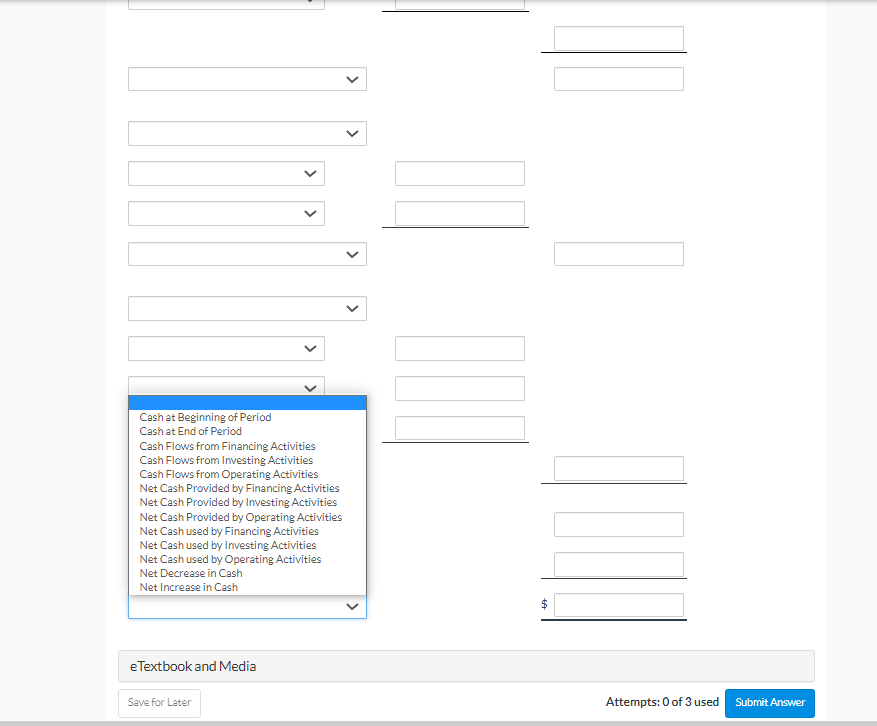

Current Attempt in Progress Shown below are comparative balance sheets for Bridgeport Company. Additional information: 1. Net income for 2022 was $148,800. 2. Depreciation expense was $54,400. 3. Cash dividends of $62,400 were declared and paid. 4. Bonds payable amounting to $80,000 were redeemed for cash $80,000. 5. Common stock was issued for $67,200 cash. Additional information: 1. Net income for 2022 was $148,800. 2. Depreciation expense was $54,400. 3. Cash dividends of $62,400 were declared and paid. 4. Bonds payable amounting to $80,000 were redeemed for cash $80,000. 5. Common stock was issued for $67,200 cash. 6. No equipment was sold during 2022 . 7. Land was sold for its book value. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. Question 3 of 5> /10 eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 45,000, or in parenthesis e.g. (45,000)). Question 3 of 5 /10 Cash at Beginning of Period Cashat End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Net Increase in Cash Question 3 of 5 /10: \begin{tabular}{l} Decrease in Accounts Payable \\ Decrease in Accounts Receivable \\ Decrease in Inventory \\ Depreciation Expense \\ Increase in Accounts Payable \\ Increase in Accounts Receivable Inventory \\ Issuance of Common Stock \\ Net Income \\ Payment of Cash Dividends \\ Purchase of Equipment \\ Redemption of Bonds \\ Sale of Land \\ \hline \end{tabular} Question 3 of 5 /10: Adjustments to reconcile net income to \begin{tabular}{l} Decrease in Accounts Payable \\ Decrease in Accounts Receivable \\ Decrease in Inventory \\ Depreciation Expense \\ Increase in Accounts Payable \\ Increase in Accounts Receivable \\ Increase in Inventory \\ Issuance of Common Stock \\ Net Income \\ Payment of Cash Dividends \\ Purchase of Equipment \\ Redemption of Bonds \\ Sale of Land \\ \hline \end{tabular} Question 3 of 5 $ Adjustments to reconcile net income to Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Depreciation Expense Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Issuance of Common Stock Net Income Payment of Cash Dividends Purchase of Equipment Redemption of Bonds Sale of Land Question 3 of 5 $ Adjustments to reconcile net income to \begin{tabular}{|l|l|l|l|l|l|l|l} \hline Decrease in Accounts Payable \\ Decrease in Accounts Receivable \\ Decrease in Inventory \\ Increase in Accounts Payable \\ Increase in Accounts Receivable \\ Increase in Inventory \\ Net Income Common Stock \\ Payment of Cash Dividends \\ Purchase of Equipment \\ Redemption of Bonds \\ Sale of Land \end{tabular} Cashat Beginning of Period Cashat End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Net Increase in Cash eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer \begin{tabular}{l} \hline Cash at Beginning of Period \\ Cash at End of Period \\ Cash Flows from Financing Activities \\ Cash Flows from Investing Activities \\ Cash Flows from Operating Activities \\ Net Cash Provided by Financing Activities \\ Net Cash Provided by Investing Activities \\ Net Cash Provided by Operating Activities \\ Net Cash used by Financing Activities \\ Net Cash used by Investing Activities \\ Net Cash used by Operating Activities \\ Net Decrease in Cash \\ Net Increase in Cash \\ \hline \end{tabular} eTextbook and Media $ Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Depreciation Expense Increase in Accounts Payable Increase in Accounts Receivable Inventory Issuance of Common Stock Net Income Payment of Cash Dividends Purchase of Equipment Redemption of Bonds Sale of Land eTextbook and Media Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Depreciation Expense Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Issuance of Common Stock Net Income Payment of Cash Dividends Purchase of Equipment Redemption of Bonds Sale of Land eTextbook and Media Cashat Beginning of Period Cashat End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Net Increase in Cash eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Cash at Beginning of Period Cashat End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Increase in Cash eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Cash at Beginning of Period Cashat End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Increase in Cash eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer \begin{tabular}{|l|l|} \hline Decrease in Accounts Payable \\ Decrease in Accounts Receivable \\ Decrease in Inventory \\ Depreciation Expense \\ Increase in Accounts Payable \\ Increase in Accounts Receivable \\ Increase in Inventory \\ Issuance of Common Stock \\ Net Income \\ Payment of Cash Dividends \\ Purchase of Equipment \\ Redemption of Bonds \\ Sale of Land \end{tabular} eTextbook and Media Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts