Question: 3. Calculation Problems(10pts each) (1) Determine the Present value if the deposits are made into an account paying annual interest rate of 12%, assuming that

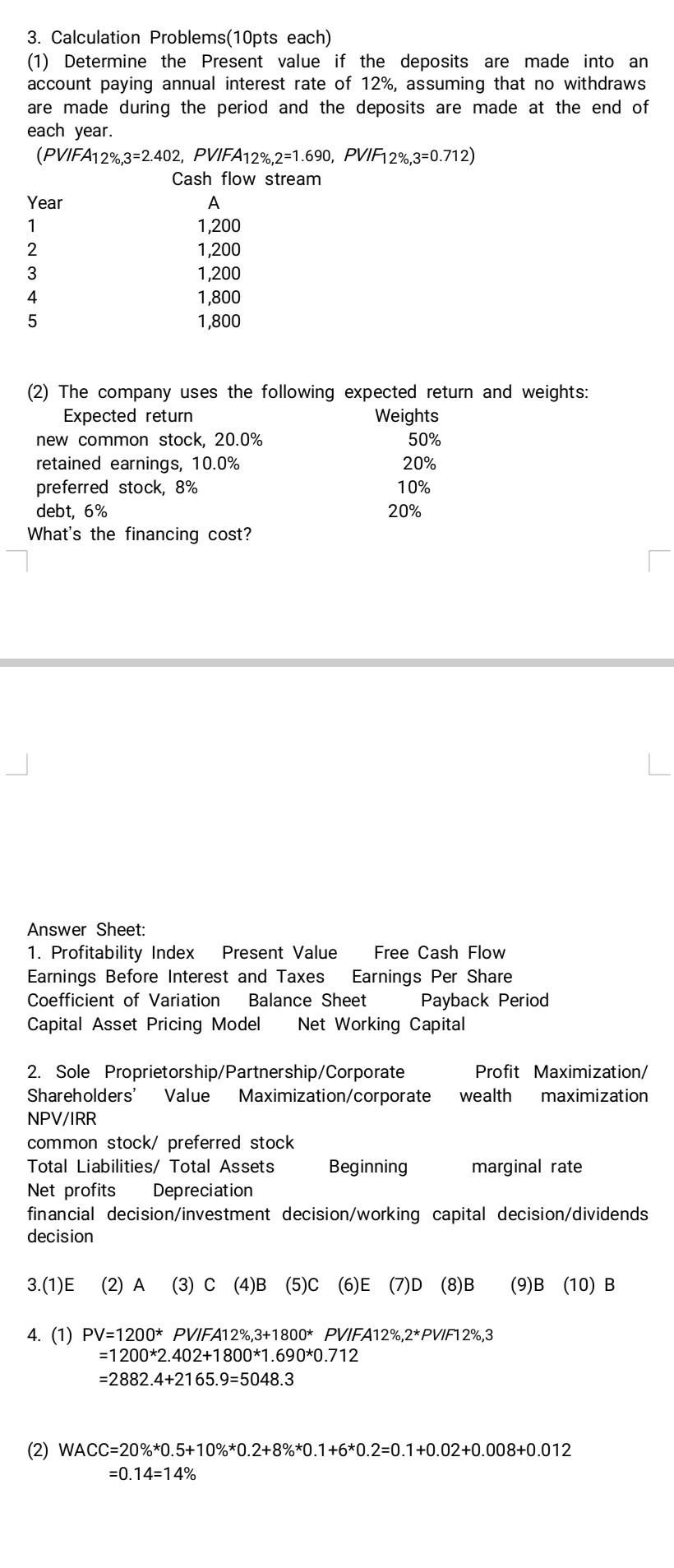

3. Calculation Problems(10pts each) (1) Determine the Present value if the deposits are made into an account paying annual interest rate of 12%, assuming that no withdraws are made during the period and the deposits are made at the end of each year. (PVIFA12%,3=2.402, PVIFA12%, 2-1.690, PVIF12%,3-0.712) Cash flow stream Year A 1 1,200 2 1,200 3 1,200 4 1,800 5 1,800 (2) The company uses the following expected return and weights: Expected return Weights new common stock, 20.0% 50% retained earnings, 10.0% preferred stock, 8% debt, 6% 20% What's the financing cost? Answer Sheet: Free Cash Flow 1. Profitability Index Present Value Earnings Before Interest and Taxes Earnings Per Share Coefficient of Variation Balance Sheet Capital Asset Pricing Model Net Working Capital Payback Period 2. Sole Proprietorship/Partnership/Corporate Shareholders' Value Maximization/corporate NPV/IRR Profit Maximization/ wealth maximization common stock/ preferred stock Total Liabilities/ Total Assets Beginning marginal rate Net profits Depreciation financial decision/investment decision/working capital decision/dividends decision 3.(1)E (2) A (3) C (4)B (5)C (6)E (7)D (8)B (9) B (10) B 4. (1) PV=1200* PVIFA12%, 3+1800* PVIFA12%,2*PV/F12%,3 =1200*2.402+1800*1.690*0.712 =2882.4+2165.9-5048.3 (2) WACC-20%*0.5+10% *0.2+8% *0.1+6*0.2=0.1 +0.02+0.008+0.012 =0.14=14% 20% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts