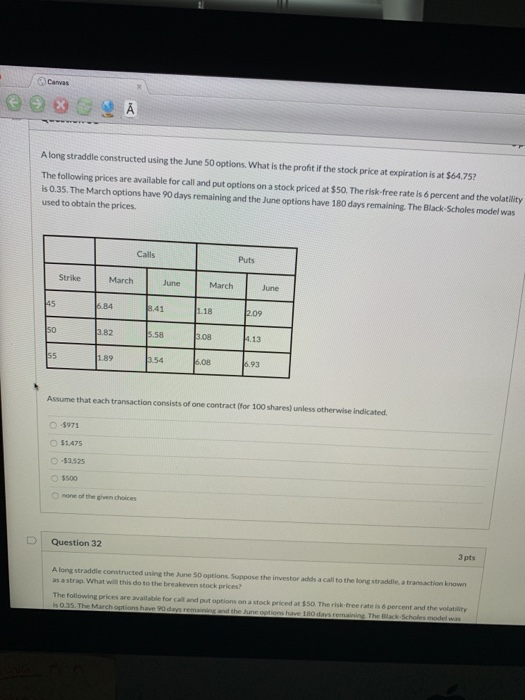

Question: 3 Canvas A long straddle constructed using the June 50 options. What is the profit if the stock price at expiration is at $64.75? The

3 Canvas A long straddle constructed using the June 50 options. What is the profit if the stock price at expiration is at $64.75? The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices. Calls Puts Strike March June March June 6.84 41 1.18 .09 .82 .58 08 13 1.89 93 Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated. -$971 $1,475 O-$3525 O $500 none of the grvenchoices D Question 32 3 pts A long straddle constructed using the June 50 options Suppose the investor adds a call to the long straddle,a transaction known as a strap. What will this do to the breakeven stock prices? The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts