Question: (3) Casper Landsten is a foreign exchange trader for a bank in New York. He has $1 million (or its Swiss franc equivalent) for a

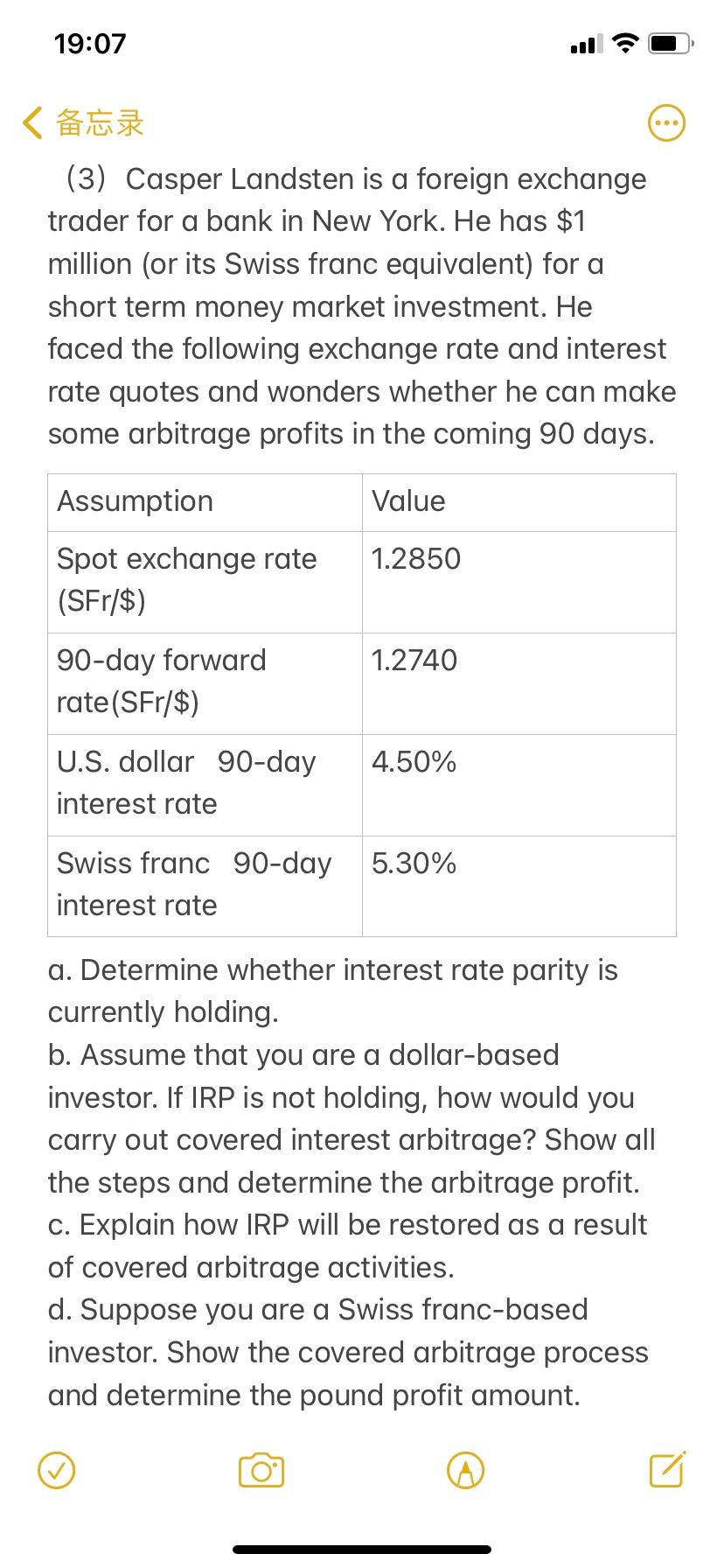

(3) Casper Landsten is a foreign exchange trader for a bank in New York. He has $1 million (or its Swiss franc equivalent) for a short term money market investment. He faced the following exchange rate and interest rate quotes and wonders whether he can make some arbitrage profits in the coming 90 days. a. Determine whether interest rate parity is currently holding. b. Assume that you are a dollar-based investor. If IRP is not holding, how would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit. c. Explain how IRP will be restored as a result of covered arbitrage activities. d. Suppose you are a Swiss franc-based investor. Show the covered arbitrage process and determine the pound profit amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts