Question: 3 Chapter 09 Assignments value 10.00 points Smith Distributors, Inc., supplies ice cream shops with various toppings for making sundaes. On November 17, 2016, a

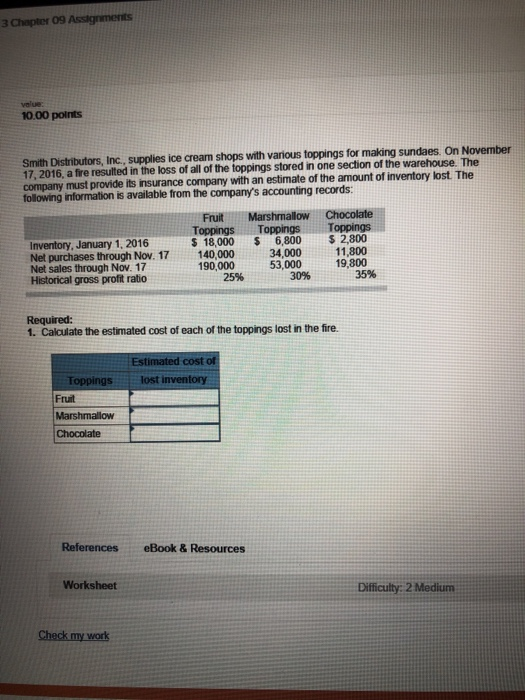

3 Chapter 09 Assignments value 10.00 points Smith Distributors, Inc., supplies ice cream shops with various toppings for making sundaes. On November 17, 2016, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company with an estimate of the amount of inventory lost The following information is available from the company's accounting records: Fruit MarshmalloW Toppings Toppings Toppings $18,000 $6,800 $2,800 Inventory, January 1, 2016 Net purchases through Nov. 17 Net sales through Nov. 17 140,000 190,000 34,000 53,000 11,800 19,800 Historical gross profit ratio 25% 30% 35% Required: 1. Calculate the estimated cost of each of the toppings lost in the fire. Estimated cost of Toppingslost inventory Fruit Marshmallow Chocolate References eBook&Resources Worksheet Difficulty: 2 Medium Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts