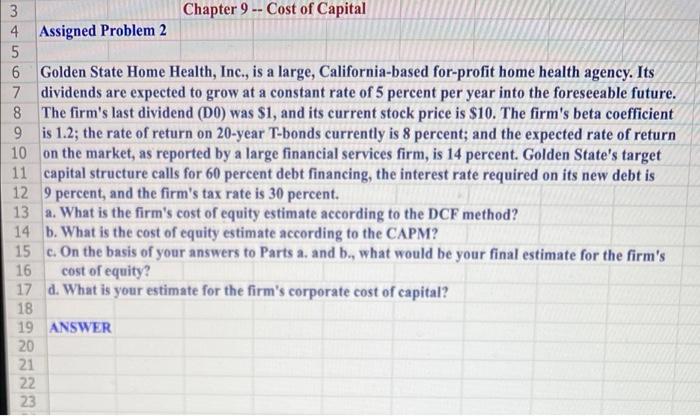

Question: 3 Chapter 9 -- Cost of Capital 4 Assigned Problem 2 5 6 Golden State Home Health, Inc., is a large, California-based for-profit home health

3 Chapter 9 -- Cost of Capital 4 Assigned Problem 2 5 6 Golden State Home Health, Inc., is a large, California-based for-profit home health agency. Its 7 dividends are expected to grow at a constant rate of 5 percent per year into the foreseeable future. 8 The firm's last dividend (DO) was S1, and its current stock price is $10. The firm's beta coefficient 9 is 1.2; the rate of return on 20-year T-bonds currently is 8 percent; and the expected rate of return 10 on the market, as reported by a large financial services firm, is 14 percent. Golden State's target 11 capital structure calls for 60 percent debt financing, the interest rate required on its new debt is 129 percent, and the firm's tax rate is 30 percent. 13 a. What is the firm's cost of equity estimate according to the DCF method? 14 b. What is the cost of equity estimate according to the CAPM? 15 c. On the basis of your answers to Parts a, and b., what would be your final estimate for the firm's 16 cost of equity? 17 d. What is your estimate for the firm's corporate cost of capital? 18 19 ANSWER 20 21 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts