Question: 3. Chapter b Multiple Choice 05-060, Section b Multiple Choice 05-060, Problem b Multiple Choice 05-060 You are considering two equally risky annuities, each of

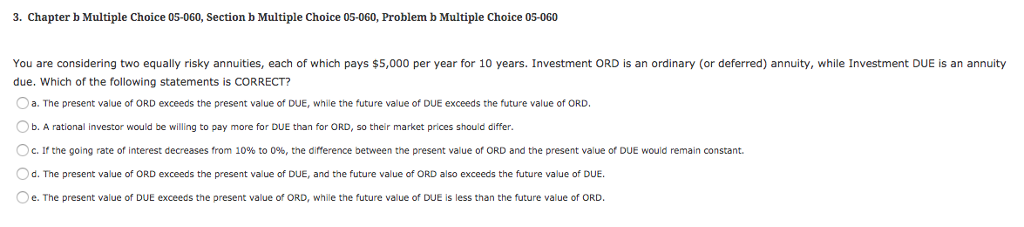

3. Chapter b Multiple Choice 05-060, Section b Multiple Choice 05-060, Problem b Multiple Choice 05-060 You are considering two equally risky annuities, each of which pays $5,000 per year for 10 years. Investment ORD is an ordinary (or deferred) annuity, while Investment DUE is an annuity due. Which of the following statements is CORRECT? a. The present value of ORD exceeds the present value of DUE, while the future value of DUE exceeds the future value of ORD. b. A rational investor would be willing to pay more for DUE than for ORD, so their market prices should differ. c. If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant. Od. The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE. e. The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts