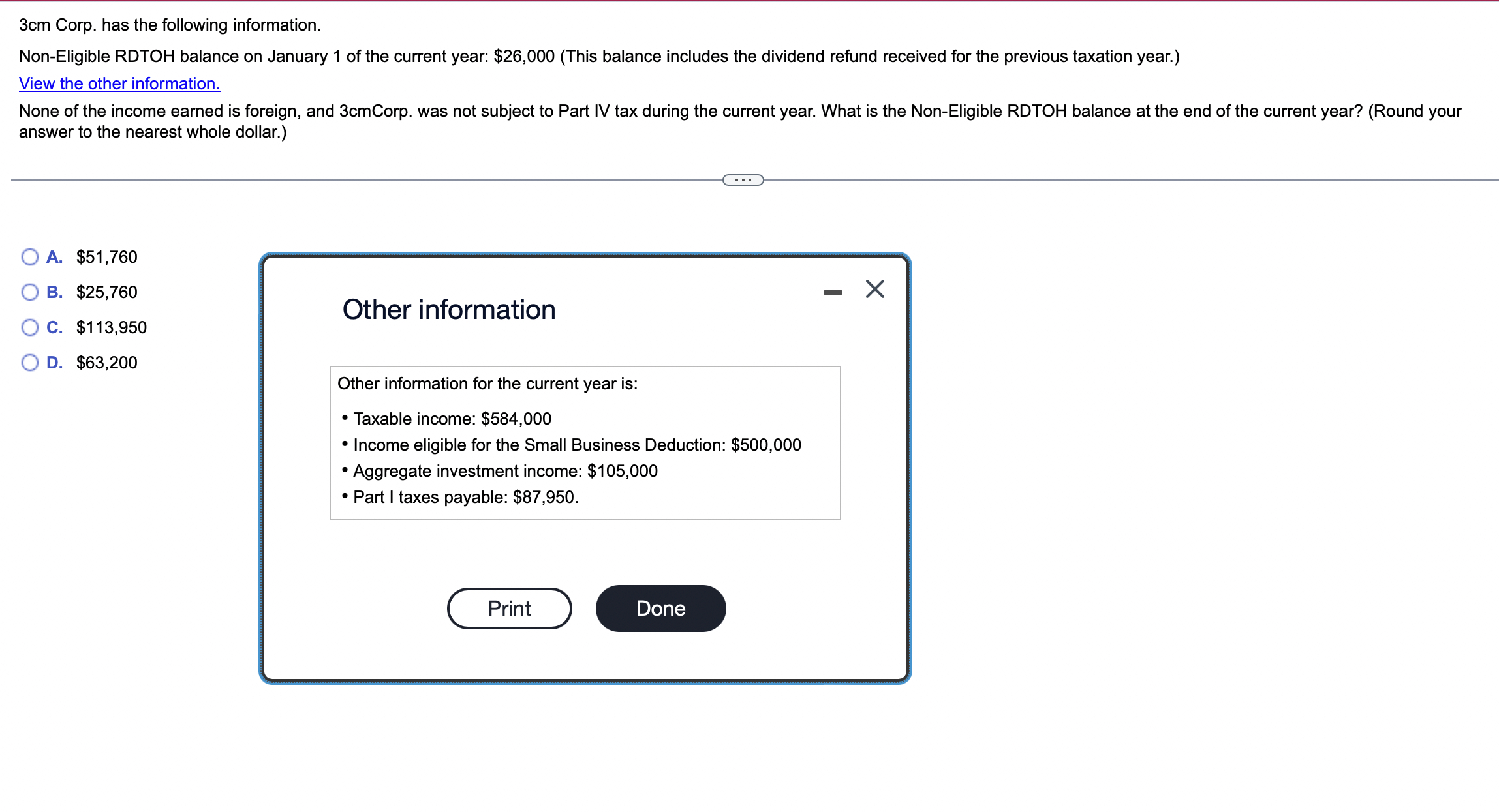

Question: 3 cm Corp. has the following information. Non - Eligible RDTOH balance on January 1 of the current year: $ 2 6 , 0 0

cm Corp. has the following information.

NonEligible RDTOH balance on January of the current year: $This balance includes the dividend refund received for the previous taxation year.

View the other information.

None of the income earned is foreign, and cmCorp. was not subject to Part IV tax during the current year. What is the NonEligible RDTOH balance at the end of the current year? Round your answer to the nearest whole dollar.

A $

B $

C $

Other information

D $

Other information for the current year is:

Taxable income: $

Income eligible for the Small Business Deduction: $

Aggregate investment income: $

Part I taxes payable: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock