Question: 3. Coca Cola example: Given the following information answer the questions below From 1927 to 2011 (1020 months) the Average Coca Cola return has been

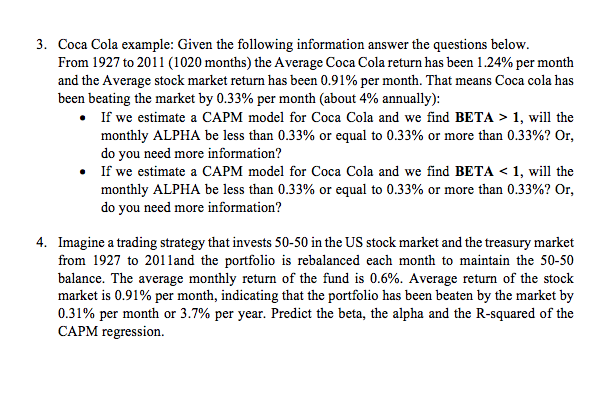

3. Coca Cola example: Given the following information answer the questions below From 1927 to 2011 (1020 months) the Average Coca Cola return has been 1.24% per month and the Average stock market return has been 0.91% per month. That means Coca cola has been beating the market by 0.33% per month (about 4% annually) If we estimate a CAPM model for Coca Cola and we find BETA > 1, will the monthly ALPHA be less than 0.33% or equal to 0.33% or more than 0.33%? Or do you need more information? If we estimate a CAPM model for Coca Cola and we find BETA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts