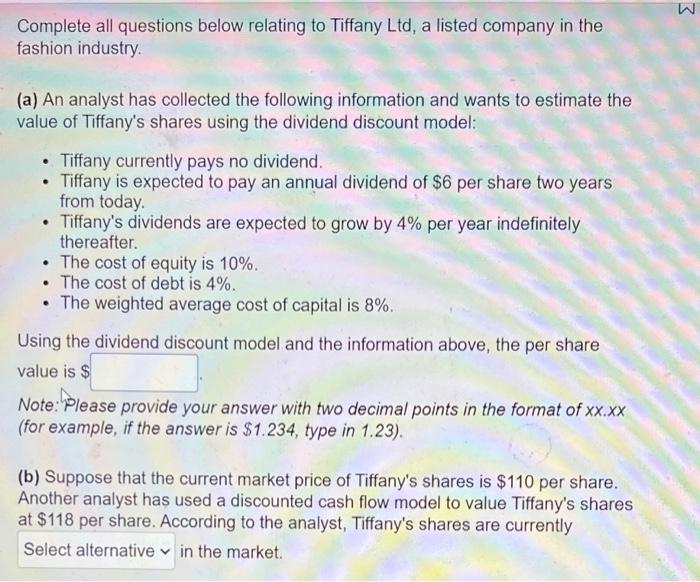

Question: 3 Complete all questions below relating to Tiffany Ltd, a listed company in the fashion industry . . (a) An analyst has collected the following

3 Complete all questions below relating to Tiffany Ltd, a listed company in the fashion industry . . (a) An analyst has collected the following information and wants to estimate the value of Tiffany's shares using the dividend discount model: Tiffany currently pays no dividend. Tiffany is expected to pay an annual dividend of $6 per share two years from today. Tiffany's dividends are expected to grow by 4% per year indefinitely thereafter. The cost of equity is 10%. The cost of debt is 4%. The weighted average cost of capital is 8%. Using the dividend discount model and the information above, the per share value is $ Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is $1.234, type in 1.23). . (b) Suppose that the current market price of Tiffany's shares is $110 per share. Another analyst has used a discounted cash flow model to value Tiffany's shares at $118 per share. According to the analyst, Tiffany's shares are currently Select alternative in the market. V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts