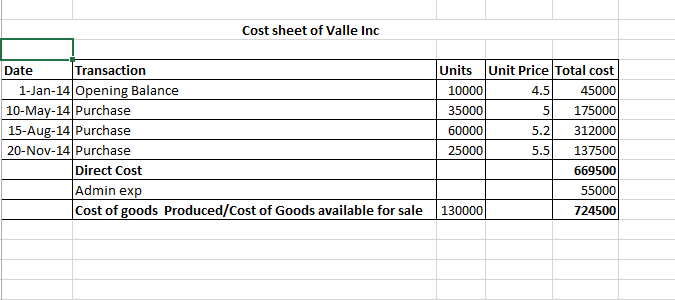

Question: 3. Complete the condensed Income Statement below (round to a whole number) Valle Inc. Income Statement For the Year Ended December 31, 2014 FIFO LIFO

| 3. | Complete the condensed Income Statement below (round to a whole number) | |||||||||||||

| Valle Inc. | ||||||||||||||

| Income Statement | ||||||||||||||

| For the Year Ended December 31, 2014 | ||||||||||||||

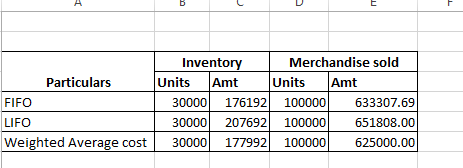

| FIFO | LIFO | Average Cost | ||||||||||||

| Sales | $ | |||||||||||||

| Less: | Sales returns and allowances | |||||||||||||

| Sales discounts | ||||||||||||||

| Net sales | ||||||||||||||

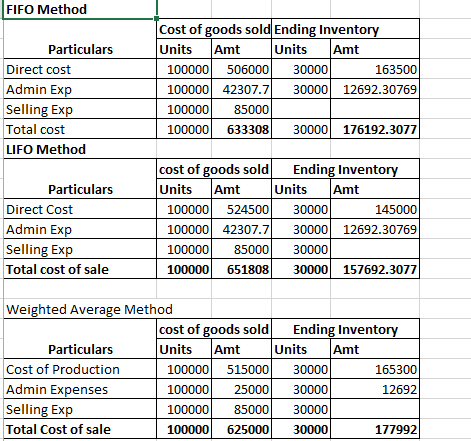

| Cost of goods sold | ||||||||||||||

| Gross profit | ||||||||||||||

| Operating expenses: | ||||||||||||||

| Selling expenses | ||||||||||||||

| Administrative expenses | ||||||||||||||

| Total operating expenses | ||||||||||||||

| Income from operations - before income taxes | ||||||||||||||

| Income taxes (21%) | ||||||||||||||

| Net income | $ | |||||||||||||

| Valle Inc. | ||||||||||||||

| Retained Earnings Statement | ||||||||||||||

| For the Year Ended December 31, 2014 | ||||||||||||||

| FIFO | LIFO | Average Cost | ||||||||||||

| Retained Earnings, January 1, 2014 | $ | 71,893 | $ | 71,893 | $ | 71,893 | ||||||||

| Net income | ||||||||||||||

| Less: Dividends | 3,000 | 3,000 | 3,000 | |||||||||||

| Increase in retained earnings | ||||||||||||||

| Retained Earnings, December 31, 2014 | ||||||||||||||

| Valle Inc. | ||||||||||||||

| Balance Sheet | ||||||||||||||

| December 31, 2014 | ||||||||||||||

| FIFO | LIFO | Average Cost | ||||||||||||

| Current Assets: | ||||||||||||||

| Cash | 36,013 | 36,013 | 36,013 | |||||||||||

| Accounts Receivable | 13,600 | 13,600 | 13,600 | |||||||||||

| Merchandise Inventory | ||||||||||||||

| Total Current Assets | ||||||||||||||

| Plant Assets: | ||||||||||||||

| Equipment | 165,000 | 165,000 | 165,000 | |||||||||||

| Less: Accumuluated Depreciation | 99,000 | 99,000 | 99,000 | |||||||||||

| Total plant assets | 66,000 | 66,000 | 66,000 | |||||||||||

| Total Assets | ||||||||||||||

| Current Liabilities: | ||||||||||||||

| Accounts Payable | 17,800 | 17,800 | 17,800 | |||||||||||

| Taxes Payable | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Common Stock | 50,000 | 50,000 | 50,000 | ` | ||||||||||

| Retained Earnings | ||||||||||||||

| Total Stockholders' Equity | ||||||||||||||

| Total liabilities and stockholders' equity | ||||||||||||||

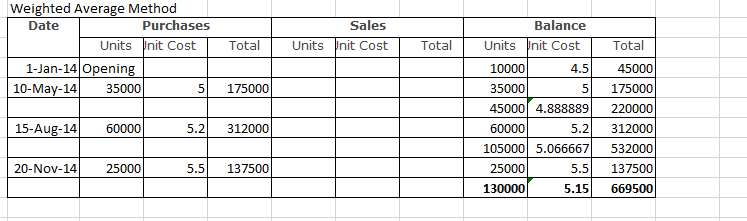

| FIFO | LIFO | Average Cost | ||||||||||||

| check | 0 | 0 | 0 | |||||||||||

| 4. | Answer the following questions: | FIFO | LIFO | Average Cost | ||||||||||

| a. | Calculate the gross profit percentage: | |||||||||||||

| (round to one decimal place) | ||||||||||||||

| b. | In this example, which of the three inventory costing methods results in the highest total assets? Why? | |||||||||||||

| In this example, which of the three inventory costing methods results in the highest owner's equity? Why? | ||||||||||||||

| c. | ||||||||||||||

| Would your answer to b. & c. above change if the units prices had decreased with each purchase? Why? | ||||||||||||||

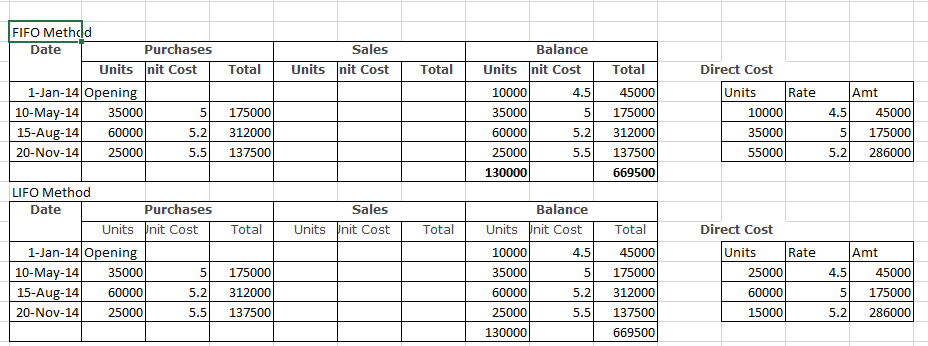

| d. | Where did the 10,000 units in beginning inventory come from? | |||||||||||||

| e. | In each method the dollar amount of ending inventory + the dollar amount of cost of goods sold | |||||||||||||

| will always equal what? | ||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock