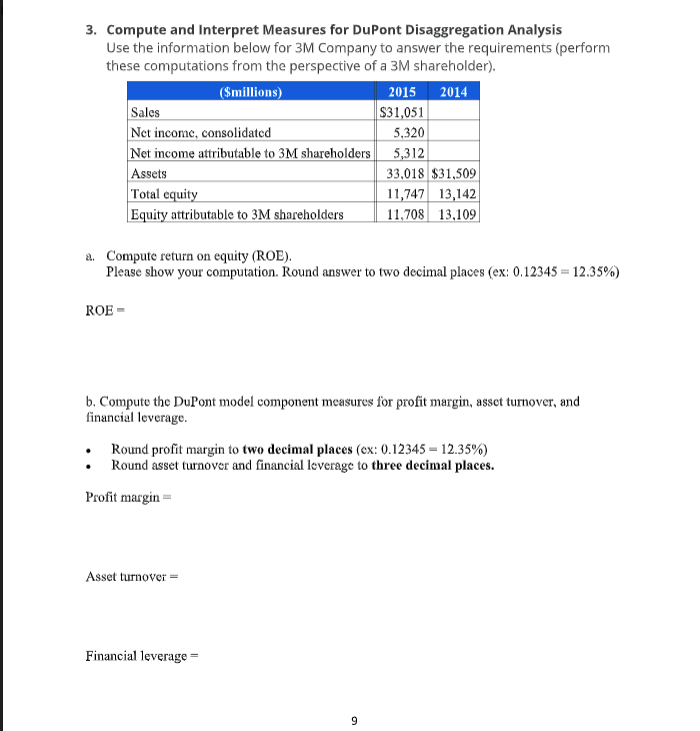

Question: 3. Compute and Interpret Measures for DuPont Disaggregation Analysis Use the information below for 3M Company to answer the requirements (perform these computations from the

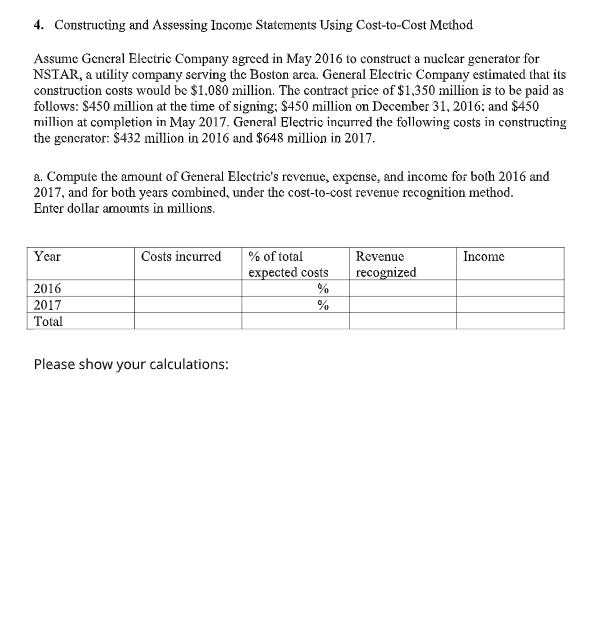

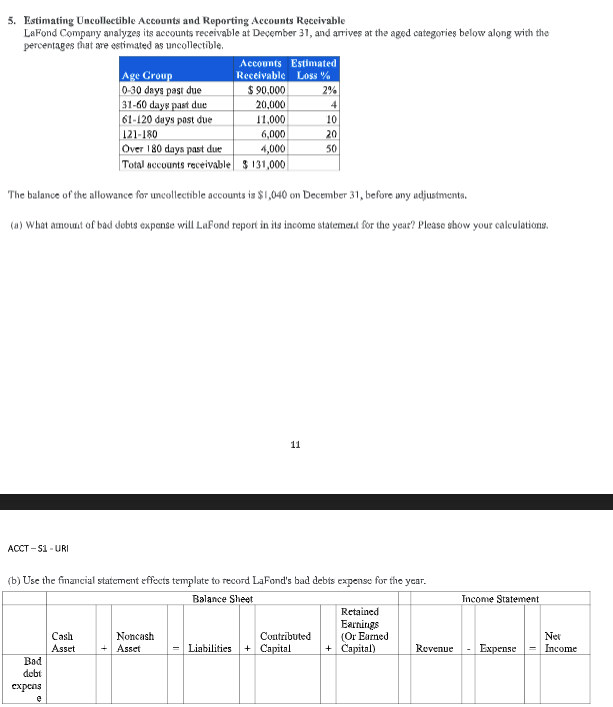

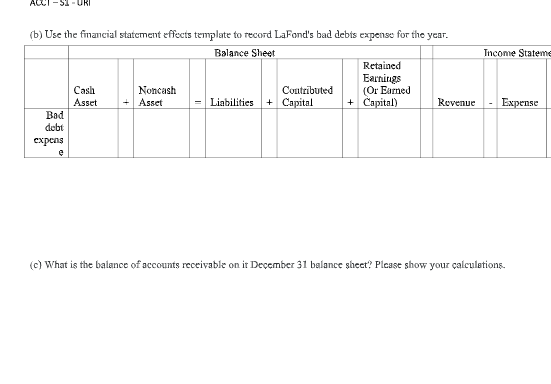

3. Compute and Interpret Measures for DuPont Disaggregation Analysis Use the information below for 3M Company to answer the requirements (perform these computations from the perspective of a 3M shareholder). ($millions) 2015 2014 Sales $31,051 Net income, consolidated 5,320 Net income attributable to 3M shareholders 5,312 Assets 33,018 $31,509 Total equity 11,747 13,142 Equity attributable to 3M shareholders 11,708 13,109 2. Computo return on equity (ROE). Please show your computation. Round answer to two decimal places (ex: 0.12345 = 12.35%) ROE b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. Round profit margin to two decimal places (ex: 0.12345 12.35%) Round asset turnover and financial leverage to three decimal places. Profit margin= Asset turnover Financial leverage- 9 4. Constructing and Assessing Income Statements Using Cost-to-Cost Method Assume General Electric Company agreed in May 2016 to construct a nuclear generator for NSTAR, a utility company serving the Boston arca. General Electric Company estimated that its construction costs would be $1,080 million. The contract price of $1,350 million is to be paid as follows: $450 million at the time of signing: $450 million on December 31, 2016; and $450 million at completion in May 2017. General Electric incurred the following costs in constructing the generator: $432 million in 2016 and $648 million in 2017. a. Compute the amount of General Electric's revenue, expense, and income for both 2016 and 2017, and for both years combined, under the cost-to-cost revenue recognition method. Enter dollar amounts in millions. Year Costs incurred Income Revenue recognized % of total expected costs % % 2016 2017 Total Please show your calculations: 5. Estimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the aged categories below along with the percentages that are estimated as uncollectible, Accounts Estimated Age Group Receivable Loss 0-30 days past due $ 90,000 31-60 days past due 20,000 61-120 days post due 11,000 10 121-180 6,000 20 Over 180 days past due 4,000 50 Total accounts receivable $ 131,000 4 The balance of the allowance for uncollectible accounts is $1,040 on December 31, before my adjustments. (a) What amount of badl dubts expense will LaFond report in its income statement for the year? Please show your calculations. 11 ACCT -51 -URI Income Statement (b) Use the financial statement effects template to record LaFond's bad debis expense for the year. Balance Sheet Retained Earnings Cash Noncash Contributed (Or Earned Asset Asset Liabilities + Capital + Capital) Revenue Bad debt expens e Expense Ner Income ACCI-SI-URI Income Stateme (b) Use the financial statement effects template to record La Fond's bad debts expense for the year. Balance Sheet Retained Earnings Cash Noncash Contributed (Or Earned Asset Asset Liabilities + Capital + Capital) Revenue Bad debt expens Expense e (c) What is the balance of accounts receivable on it December 31 balance sheet? Please show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts