Question: 3. Compute the cost assigned to ending inventory using (a) FIFO. (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold

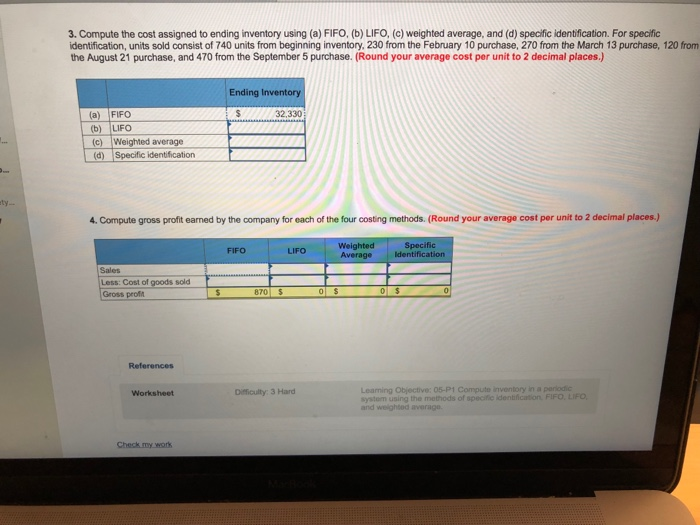

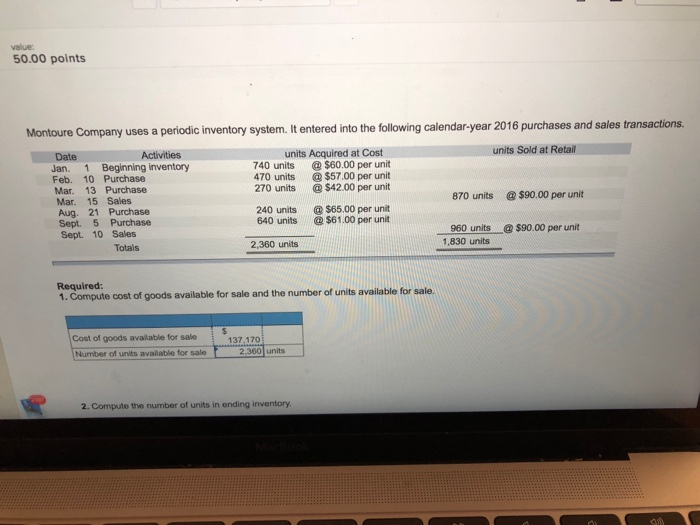

3. Compute the cost assigned to ending inventory using (a) FIFO. (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold consist of 740 units from beginning inventory, 230 from the February 10 purchase, 270 from the March 13 purchase, 120 from the August 21 purchase, and 470 from the September 5 purchase. (Round your average cost per unit to 2 decimal places.) Ending Inventory (a) FIFO (b) LIFO (c) Weighted average d) Specific identification 32,330 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) Weighted Specific Average Identifica FIFO LIFO Sales Less: Cost of goods sold Gross proft 870 S References Learning Objective: 05-P1 Compute inventory in a pariodic systom using the methods of specific identfication FIFO, LIFO and welghted average Worksheet Difficulty: 3 Hard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts