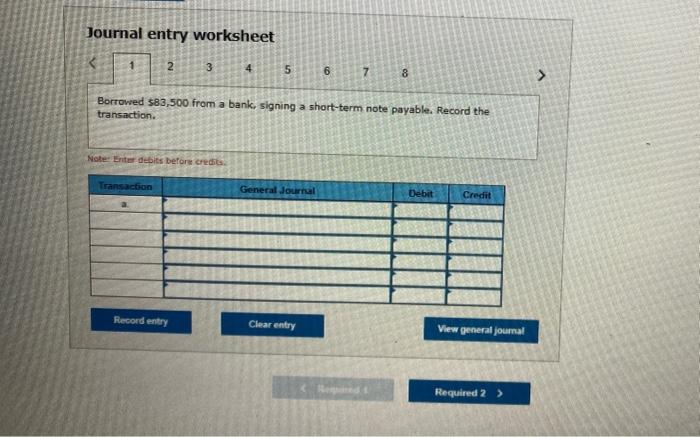

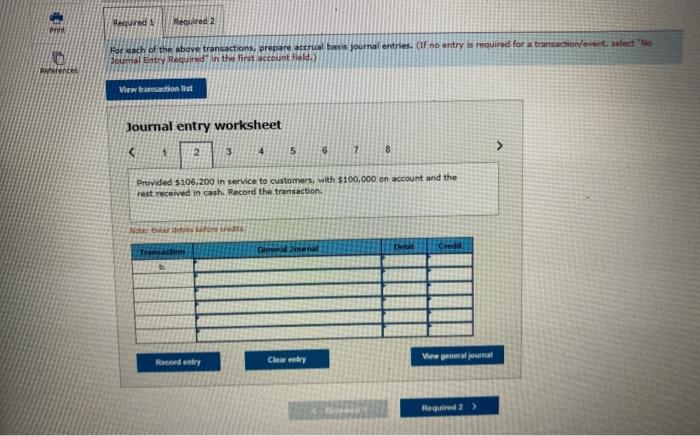

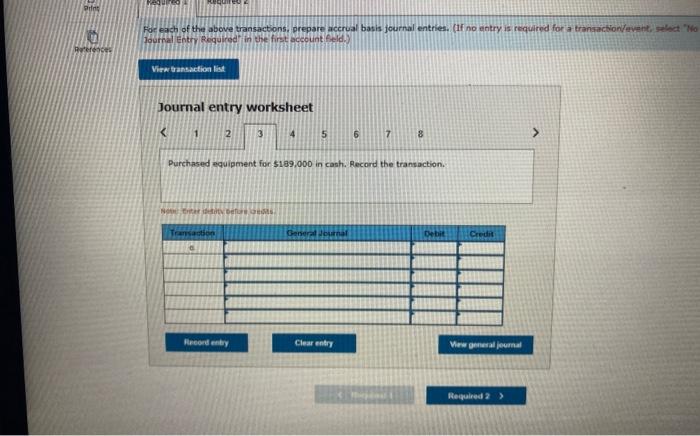

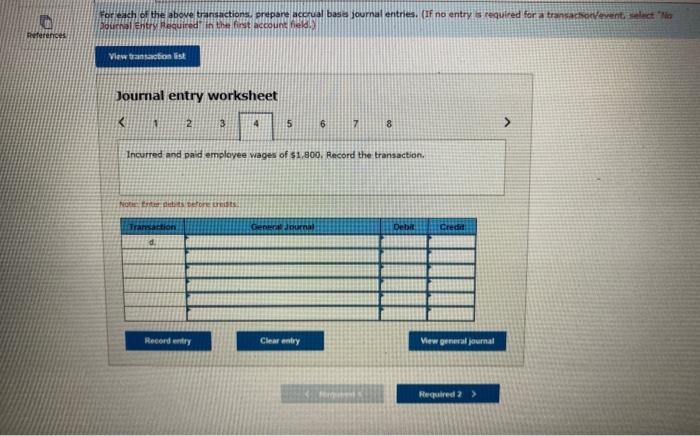

Question: Cintu is a large marketer and distributor of food service products serving restaurants, hotels, schools, hospitals, and other institutions. The following transactions are typical