Question: 3. Consider a $10000 loan. Compute the initial payment amount for each of the given interest rates and repayment schedules. Assume that all payments are

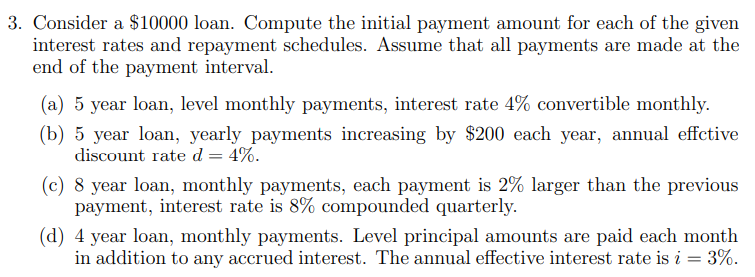

3. Consider a $10000 loan. Compute the initial payment amount for each of the given interest rates and repayment schedules. Assume that all payments are made at the end of the payment interval. (a) 5 year loan, level monthly payments, interest rate 4% convertible monthly. (b) 5 year loan, yearly payments increasing by $200 each year, annual effctive discount rate d= 4%. (C) 8 year loan, monthly payments, each payment is 2% larger than the previous payment, interest rate is 8% compounded quarterly. (d) 4 year loan, monthly payments. Level principal amounts are paid each month in addition to any accrued interest. The annual effective interest rate is i = 3%. 3. Consider a $10000 loan. Compute the initial payment amount for each of the given interest rates and repayment schedules. Assume that all payments are made at the end of the payment interval. (a) 5 year loan, level monthly payments, interest rate 4% convertible monthly. (b) 5 year loan, yearly payments increasing by $200 each year, annual effctive discount rate d= 4%. (C) 8 year loan, monthly payments, each payment is 2% larger than the previous payment, interest rate is 8% compounded quarterly. (d) 4 year loan, monthly payments. Level principal amounts are paid each month in addition to any accrued interest. The annual effective interest rate is i = 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts