Question: 3. Consider a research study performed for a large retailer. The study deals with planning and implementation of improvements in product selection, ordering, transportation,

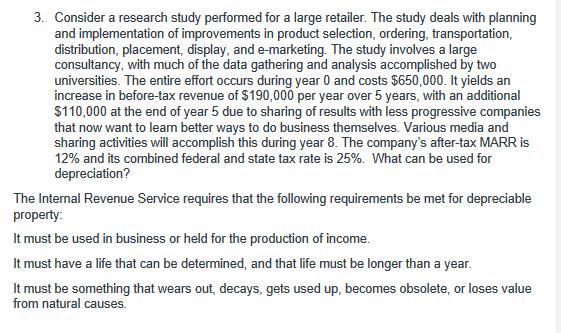

3. Consider a research study performed for a large retailer. The study deals with planning and implementation of improvements in product selection, ordering, transportation, distribution, placement, display, and e-marketing. The study involves a large consultancy, with much of the data gathering and analysis accomplished by two universities. The entire effort occurs during year 0 and costs $650,000. It yields an increase in before-tax revenue of $190,000 per year over 5 years, with an additional $110,000 at the end of year 5 due to sharing of results with less progressive companies that now want to learn better ways to do business themselves. Various media and sharing activities will accomplish this during year 8. The company's after-tax MARR is 12% and its combined federal and state tax rate is 25%. What can be used for depreciation? The Internal Revenue Service requires that the following requirements be met for depreciable property: It must be used in business or held for the production of income. It must have a life that can be determined, and that life must be longer than a year. It must be something that wears out, decays, gets used up, becomes obsolete, or loses value from natural causes.

Step by Step Solution

There are 3 Steps involved in it

Based on the requirements set by the Internal Revenue Service IRS for depreciable property the follo... View full answer

Get step-by-step solutions from verified subject matter experts