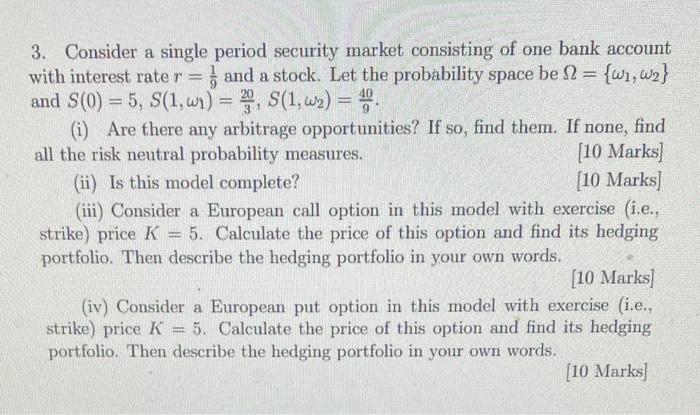

Question: -- - 3. Consider a single period security market consisting of one bank account with interest rater = 5 and a stock. Let the probability

-- - 3. Consider a single period security market consisting of one bank account with interest rater = 5 and a stock. Let the probability space be 1 = {wi,W2} and S(0) = 5, S(1,wi) = S(1,w2) = 1 (i) Are there any arbitrage opportunities? If so, find them. If none, find all the risk neutral probability measures. [10 Marks) (ii) Is this model complete? [10 Marks] (iii) Consider a European call option in this model with exercise (i.e., strike) price K = 5. Calculate the price of this option and find its hedging portfolio. Then describe the hedging portfolio in your own words. [10 Marks] (iv) Consider a European put option in this model with exercise (i.e., strike) price K = 5. Calculate the price of this option and find its hedging portfolio. Then describe the hedging portfolio in your own words. [10 Marks] -- - 3. Consider a single period security market consisting of one bank account with interest rater = 5 and a stock. Let the probability space be 1 = {wi,W2} and S(0) = 5, S(1,wi) = S(1,w2) = 1 (i) Are there any arbitrage opportunities? If so, find them. If none, find all the risk neutral probability measures. [10 Marks) (ii) Is this model complete? [10 Marks] (iii) Consider a European call option in this model with exercise (i.e., strike) price K = 5. Calculate the price of this option and find its hedging portfolio. Then describe the hedging portfolio in your own words. [10 Marks] (iv) Consider a European put option in this model with exercise (i.e., strike) price K = 5. Calculate the price of this option and find its hedging portfolio. Then describe the hedging portfolio in your own words. [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts