Question: 3. Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly

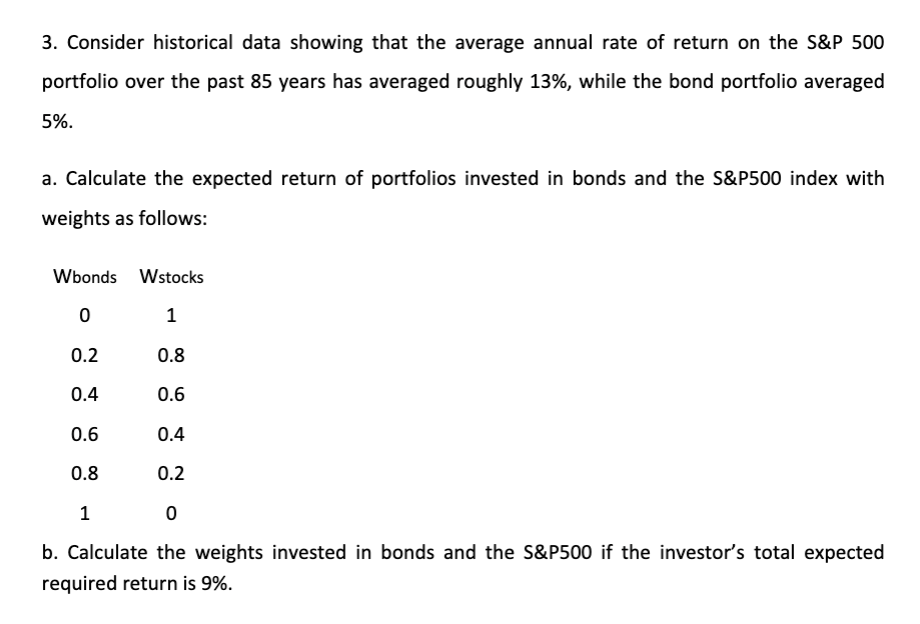

3. Consider historical data showing that the average annual rate of return on the S\&P 500 portfolio over the past 85 years has averaged roughly 13%, while the bond portfolio averaged 5%. a. Calculate the expected return of portfolios invested in bonds and the S\&P500 index with weights as follows: b. Calculate the weights invested in bonds and the S\&P500 if the investor's total expected required return is 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts