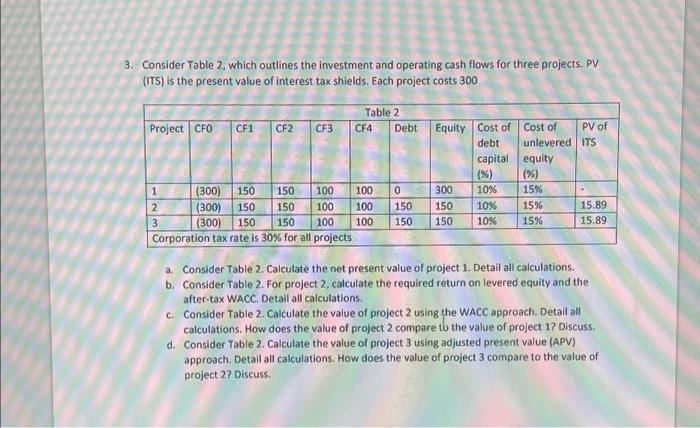

Question: 3. Consider Table 2, which outlines the investment and operating cash flows for three projects. PV (ITS) is the present value of interest tax shields.

3. Consider Table 2, which outlines the investment and operating cash flows for three projects. PV (ITS) is the present value of interest tax shields. Each project costs 300 a. Consider Table 2. Calculate the net present value of project 1. Detail all calculations. b. Consider Table 2. For project 2 , calculate the required return on levered equity and the after-tax WACC. Detail all calculations. c. Consider Table 2. Calculate the value of project 2 using the WACC approach. Detail all calculations. How does the value of project 2 compare to the value of project 1 ? Discuss. d. Consider Table 2. Calculate the value of project 3 using adjusted present value (APV) approach. Detail all calculations. How does the value of project 3 compare to the value of project 2 ? Discuss. 3. Consider Table 2, which outlines the investment and operating cash flows for three projects. PV (ITS) is the present value of interest tax shields. Each project costs 300 a. Consider Table 2. Calculate the net present value of project 1. Detail all calculations. b. Consider Table 2. For project 2 , calculate the required return on levered equity and the after-tax WACC. Detail all calculations. c. Consider Table 2. Calculate the value of project 2 using the WACC approach. Detail all calculations. How does the value of project 2 compare to the value of project 1 ? Discuss. d. Consider Table 2. Calculate the value of project 3 using adjusted present value (APV) approach. Detail all calculations. How does the value of project 3 compare to the value of project 2 ? Discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts