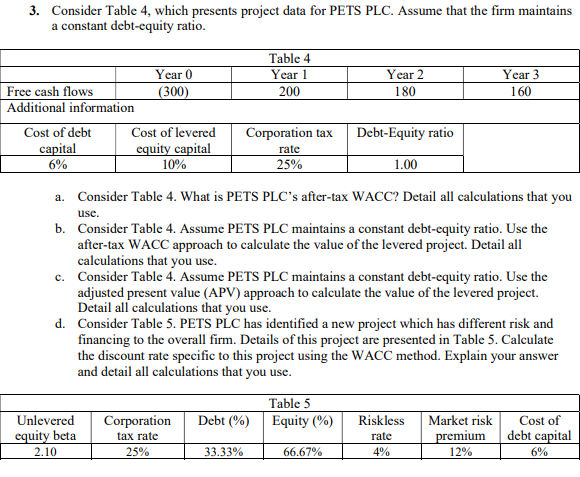

Question: 3. Consider Table 4, which presents project data for PETS PLC. Assume that the firm maintains a constant debt-equity ratio. Table 4 Year 1 200

3. Consider Table 4, which presents project data for PETS PLC. Assume that the firm maintains a constant debt-equity ratio. Table 4 Year 1 200 Year 2 180 Year 3 160 Year 0 Free cash flows (300) Additional information Cost of debt Cost of levered capital equity capital 6% 10% Debt-Equity ratio Corporation tax rate 25% 1.00 use. a. Consider Table 4. What is PETS PLC's after-tax WACC? Detail all calculations that you b. Consider Table 4. Assume PETS PLC maintains a constant debt-equity ratio. Use the after-tax WACC approach to calculate the value of the levered project. Detail all calculations that you use. c. Consider Table 4. Assume PETS PLC maintains a constant debt-equity ratio. Use the adjusted present value (APV) approach to calculate the value of the levered project. Detail all calculations that you use. d. Consider Table 5. PETS PLC has identified a new project which has different risk and financing to the overall firm. Details of this project are presented in Table 5. Calculate the discount rate specific to this project using the WACC method. Explain your answer and detail all calculations that you use. Debt (%) Table 5 Equity (%) Unlevered equity beta 2.10 Corporation tax rate 25% Riskless rate Market risk premium 12% Cost of debt capital 6% 33.33% 66.67%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts