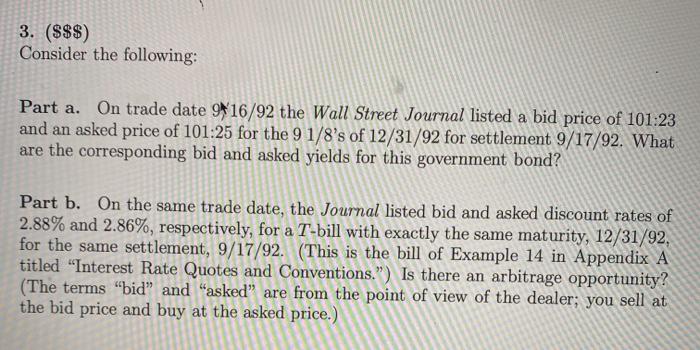

Question: 3. ($$$) Consider the following: Part a. On trade date 9*16/92 the Wall Street Journal listed a bid price of 101:23 and an asked price

3. ($$$) Consider the following: Part a. On trade date 9*16/92 the Wall Street Journal listed a bid price of 101:23 and an asked price of 101:25 for the 9 1/8's of 12/31/92 for settlement 9/17/92. What are the corresponding bid and asked yields for this government bond? Part b. On the same trade date, the Journal listed bid and asked discount rates of 2.88% and 2.86%, respectively, for a T-bill with exactly the same maturity, 12/31/92, for the same settlement, 9/17/92. (This is the bill of Example 14 in Appendix A titled "Interest Rate Quotes and Conventions.") Is there an arbitrage opportunity? (The terms "bid" and "asked are from the point of view of the dealer; you sell at the bid price and buy at the asked price.) 3. ($$$) Consider the following: Part a. On trade date 9*16/92 the Wall Street Journal listed a bid price of 101:23 and an asked price of 101:25 for the 9 1/8's of 12/31/92 for settlement 9/17/92. What are the corresponding bid and asked yields for this government bond? Part b. On the same trade date, the Journal listed bid and asked discount rates of 2.88% and 2.86%, respectively, for a T-bill with exactly the same maturity, 12/31/92, for the same settlement, 9/17/92. (This is the bill of Example 14 in Appendix A titled "Interest Rate Quotes and Conventions.") Is there an arbitrage opportunity? (The terms "bid" and "asked are from the point of view of the dealer; you sell at the bid price and buy at the asked price.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts