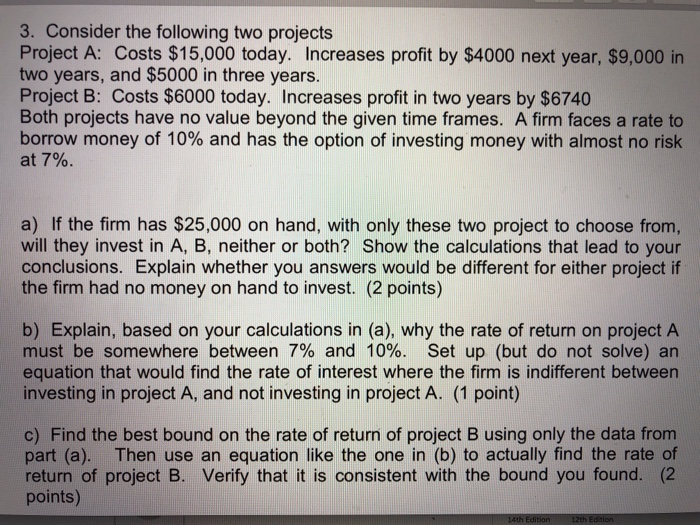

Question: 3. Consider the following two projects Project A: Costs $15,000 today. Increases profit by $4000 next year, $9,000 in two years, and $5000 in three

3. Consider the following two projects Project A: Costs $15,000 today. Increases profit by $4000 next year, $9,000 in two years, and $5000 in three years. Project B: Costs $6000 today. Increases profit in two years by $6740 Both projects have no value beyond the given time frames. A firm faces a rate to borrow money of 10% and has the option of investing money with almost no risk at 7%. a) If the firm has $25,000 on hand, with only these two project to choose from, will they invest in A, B, neither or both? Show the calculations that lead to your conclusions. Explain whether you answers would be different for either project if the firm had no money on hand to invest. (2 points) b) Explain, based on your calculations in (a), why the rate of return on project A must be somewhere between 7% and 10%. Set up (but do not solve) an equation that would find the rate of interest where the firm is indifferent between investing in project A, and not investing in project A. (1 point) c) Find the best bound on the rate of return of project B using only the data from part (a). Then use an equation like the one in (b) to actually find the rate of return of project B. Verify that it is consistent with the bound you found. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts