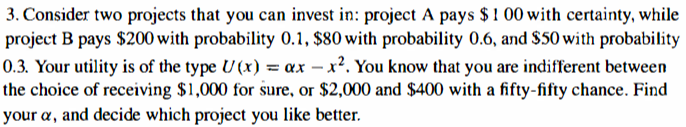

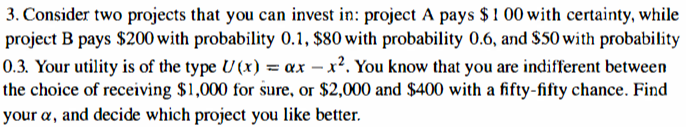

Question: 3. Consider two projects that you can invest in: project A pays $ 1 00 with certainty, while project B pays $200 with probability 0.1,

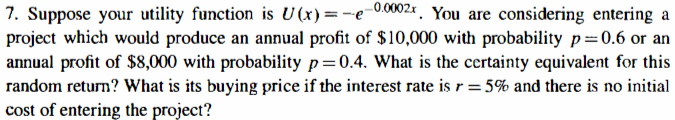

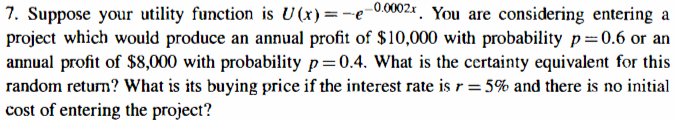

3. Consider two projects that you can invest in: project A pays $ 1 00 with certainty, while project B pays $200 with probability 0.1, $80 with probability 0.6, and $50 with probability 0.3. Your utility is of the type U(x) = ax - x2. You know that you are indifferent between the choice of receiving $1,000 for sure, or $2,000 and $400 with a fifty-fifty chance. Find your a, and decide which project you like better.7. Suppose your utility function is U(x)=-e . You are considering entering a project which would produce an annual profit of $10,000 with probability p =0.6 or an annual profit of $8,000 with probability p =0.4. What is the certainty equivalent for this random return? What is its buying price if the interest rate is r = 5% and there is no initial cost of entering the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts